Low Viscosity Engine Lubricant

In a truck’s engine, mechanical losses from pumping and friction consume approximately 16% of the total energy input of the vehicle. Lower viscosity oils—oils with less internal resistance to flow—will reduce these engine mechanical losses, thereby reducing fuel use.

Since 2003 fleets have been ramping up their investment in lower-viscosity lubricants. Yet while 40% of the largest, most efficiency-conscious fleets have adopted these engine oils, the adoption rates for the industry as a whole remain at only about 20%. However, new emissions regulations and the advent of new oil categories may increase the adoption rate.

Benefits

Fuel Savings

- 0.5% – 1.5% when switching from 15W-40 to 5W/10W-30

- 0.4% – -0.7% when switching to FA-4 oils, available after December 2016 from CJ-4/CK-4 5/10W-30 oils

Extended Oil Drain Intervals

Ability to extend oil drain varies, but one fleet expects to extended its drain interval by 20,000 miles.

Challenges

Cost

- Increased costs for fleets using non-synthetic 15W-40 oils because most 15W-40 oils are mineral based and most low-viscosity oils are synthetic or synthetic blend

- 30% to 40% cost increase when switching from a mineral-based to a synthetic-based oil

Compatibility with the Entire Fleet

- Lower-viscosity 5W/10W-30 oil version of CJ-4/CK-4 is approved for engines going back only to model year 2010

- FA-4 oils, which offer the greatest fuel efficiency gains, may have issues with backwards compatibility

Common Fleet Strategies

Case Study: National Truckload Carrier

- Fleet age: 2 years

- Average annual miles: 115,000

- Operational region: Lower 48 states and Canada

The national carrier had been using a 15W-40 mineral-based oil. An oil supplier approached the carrier to test 10W-30 engine oil. The fleet agreed to the test to improve cold-weather starting and fuel efficiency.

The fleet anticipated a 0.5% fuel consumption benefit. It faced a significant cost increase but calculated it would earn an acceptable ROI as a result of the fuel savings.

Drain intervals were kept the same and in the two years since the switch the fleet has found no issues related to lower-viscosity oil.

Case Study: Carrier with Dedicated Operations

- Fleet age: 2 years

- Average annual miles: 80,000 to 100,000

- Operational region: Lower 48 states and Canada

The national truckload carrier had considered switching to a 10W-30 oil. The fleet manager consulted with the engine supplier about available options.

Thirty vehicles were chosen for testing which included extending oil drain intervals. Oil sampling was conducted every 5,000 miles.

The fleet’s fuel testing indicated a reduction in fuel consumption of 1.5% to 1.8%. The fleet then rolled out the low-viscosity oil to its own maintenance facilities and at its offsite facilities.

What People Are Saying

Oil Companies

- “Most people associate higher viscosity with better engine protection, but that sentiment is breaking down.”

- “Most fleets and buyers of oil point to the viscosity as the primary identifier of an oil.”

- “Studies that we have commissioned indicate that the on-highway segment is about 67% to 75% 15W-40 and about 20% 10W-30, with the percentage of 10W-30 increasing as the fleet size increases.”

- “On the fuel consumption benefit of 10W-30 vs. 15W-40: “Own-truck testing indicates achievable improvements of ~1%. Span of improvements increases in applications with more stop-and-go.”

Engine Makers

- “There is a quantifiable fuel savings with lower-viscosity oils in controlled engine tests. In most cases, the improvement is bigger when measured in the field. Field testing may exceed what we see in the test.”

- On the reason for using 15W-40 vs. 10W-30: “People used to believe that the higher number is critical in determining engine protection. This is not true anymore.”

Decision-Making Tools

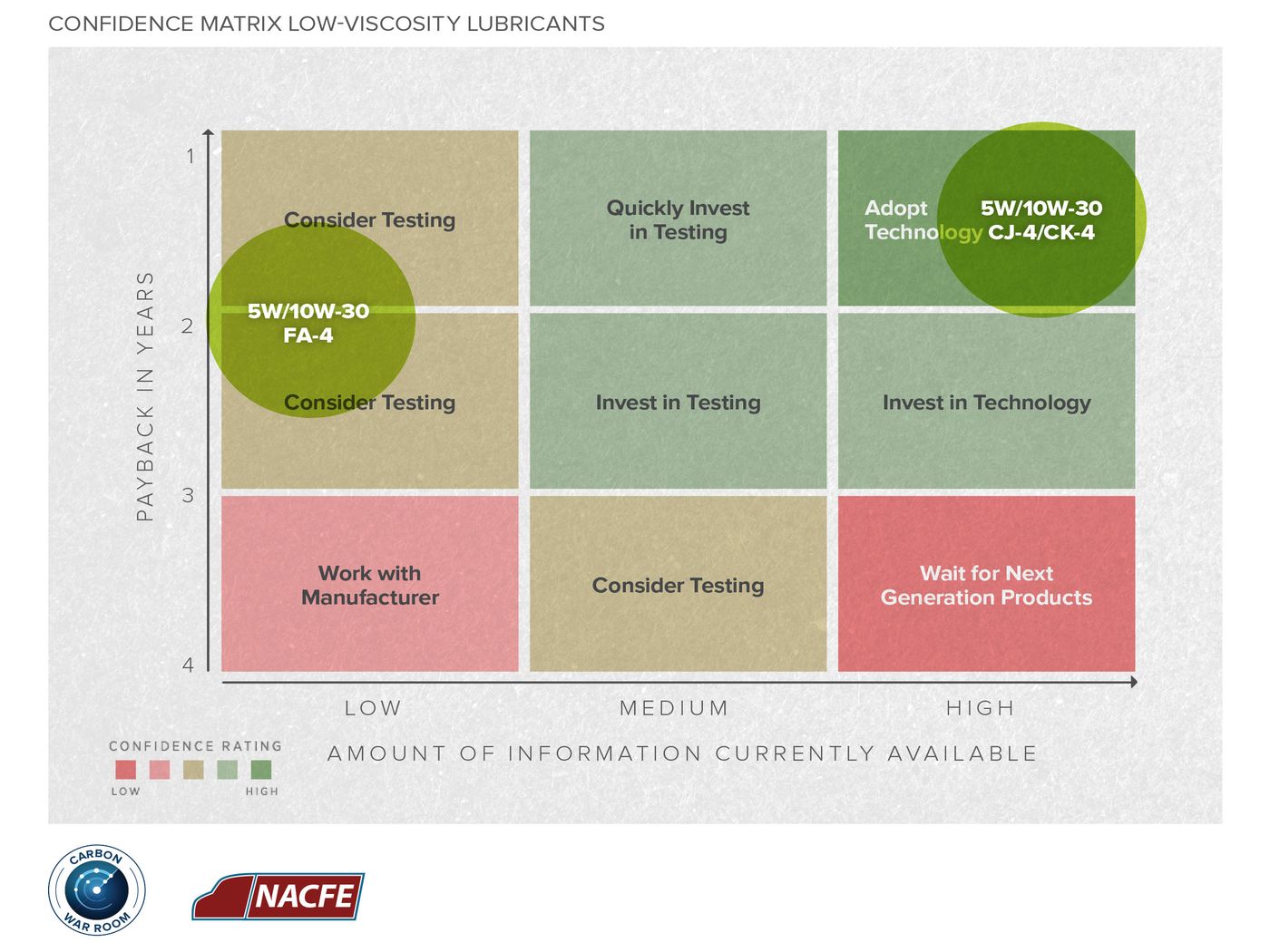

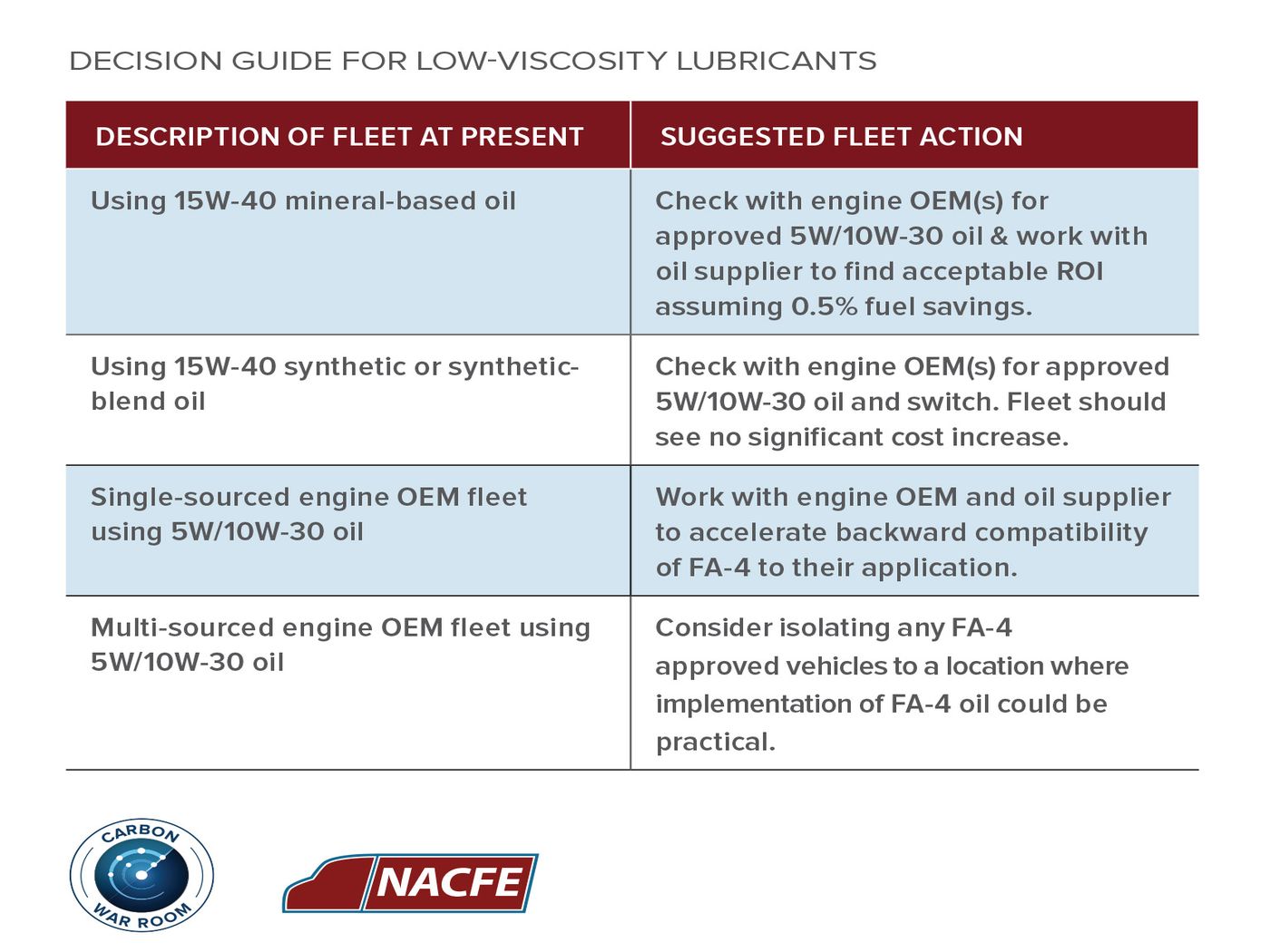

The study team developed three tools to help fleets make decisions about low-viscosity engine oil. The Confidence Matrix plots where the low-viscosity engine oil choices fall in terms of available data on the technology and how quickly fleets should realize payback. The Decision Guide can help fleets that want to benefit from the reduced fuel consumption offered by lower-viscosity engine oil. It describes the fleet’s current oil use and suggests what action a fleet needs to take.

Conclusions

- Interviews and literature indicate that Class 8 over-the-road fleets can realistically expect fuel savings in the range of 0.5% to 1.5% by switching from 15W-40 to currently available 5W/10W-30 engine oil. The savings from switching to the fuel-efficient FA-4 variant, available after December 2016, is expected to be 0.4%-0.7% when compared to CJ04/CK-4 5/10W-30 oils.

- All major North American engine OEMs have approved 5W/10W-30 engine oil for over-the-road applications. Approved oils, regardless of viscosity, meet the engine manufacturer’s requirements for engine protection.

- Within the same viscosity grade, the base stock (mineral, synthetic, or synthetic blend) does not directly affect fuel consumption.