Viable Class 7/8 Electric, Hybrid, and Alternative Fuel Tractors

Trucking is at the start of significant changes in powertrains. Fleets face a tyranny of evolving choices that include improved diesels, a seemingly endless variety of hybrid technologies including fuel cells, and a variety of straight electric ones including battery electric and catenary wire electric. Fuels are branded variously as “green,” “clean,” “near-zero emission” and “renewable” with no clear agreement on what these mean.

This report provides unbiased information on the current progress, trade-offs, and key considerations for fleets evaluating alternatives to traditional diesel powertrains.

How Are Alternative Fuels Alike?

The alternatives to traditional diesel powertrains share common factors such as:

- Unproven Reliability

- Unproven Maintainability

- Unknown Obsolescence Rate

- Unproven Product Life

- Unknown All Season/All Region Capabilities

- Higher List Cost

- Unknown Lifecycle Costs

- Need for Infrastructure Investment

- Unknown Insurance Costs

- Unknown Residual Value

- Maturation and Adoption S-Curves

How Are Alternative Fuels Different?

Comparing alternative fuels on a true apples-to-apples basis means comparing identical vehicles. Since alternative fueled vehicles are inherently not identical, each factor that is not kept similar has ramifications that impact the validity of the comparison. Alternative fuel vehicle equivalent comparisons are difficult. In order to do an accurate comparison, the following factors have to be taken into consideration:

- Energy Content of Fuels

- Tare Weight

- Payload Capacity

- Vehicle Packaging

- Energy Conversion Efficiency

- Duty Cycles

- Freight Ton Efficiency

- Freight Cube

- Energy Pricing

- Source-to-Use

- Fill Times

- System Cost

- Maintenance

- Incentives

- Other Operational Factors

Conclusions

- North American freight movement is becoming more predictable with dedicated routes enabled by e-commerce and other technologies, offering better duty cycles for alternative powertrains.

- Each alternative fuel powertrain offers benefits in the short term compared to current diesel and may have enough duty cycle scale to offer TCO and emission savings.

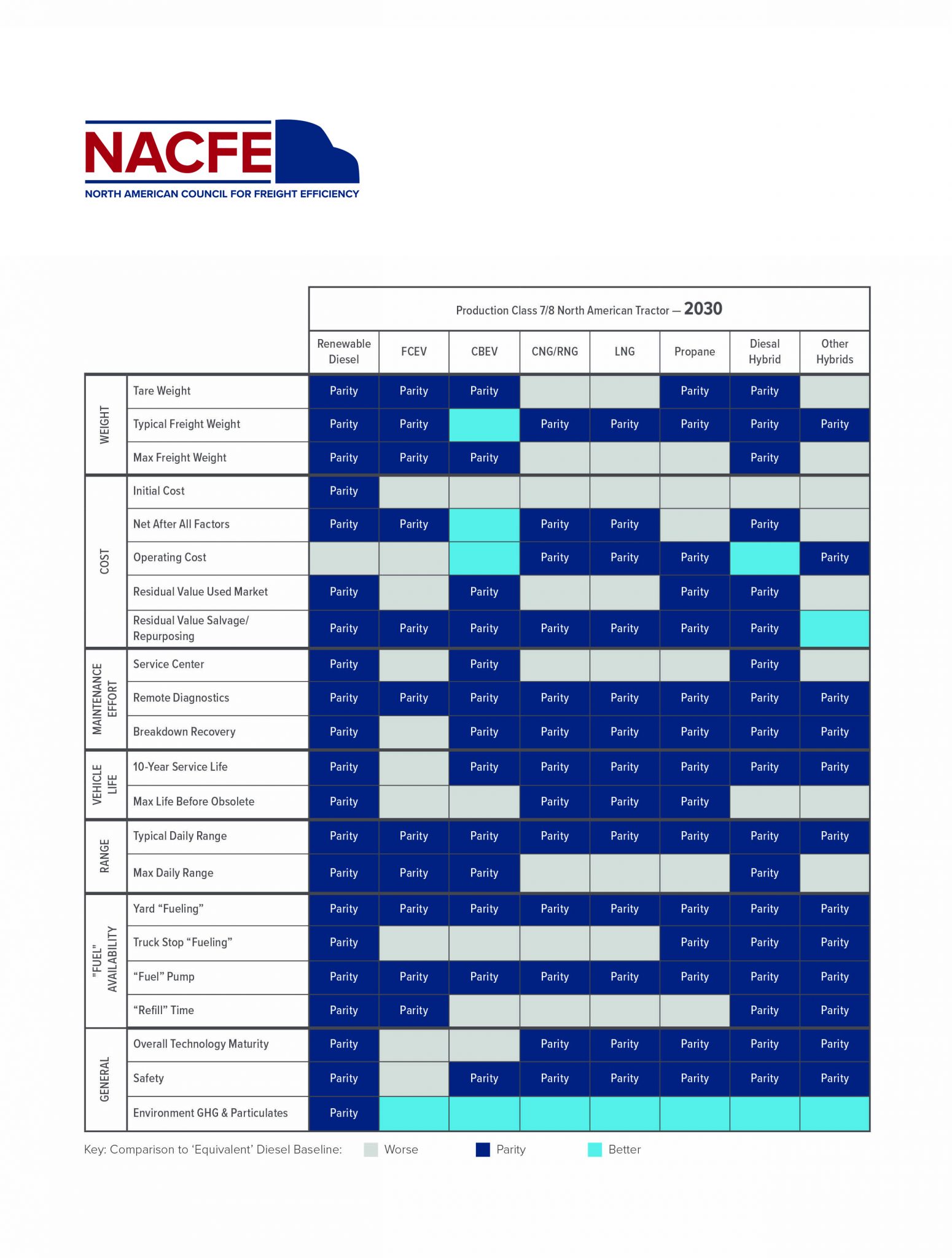

- CBEVs and Fuel Cell trucks will be capable of lower total cost of ownership in the 2030 timeframe.

- Vehicle specifications will be more optimized for the duty cycle and technology of the first user, limiting the applicability of the equipment for second or third users.

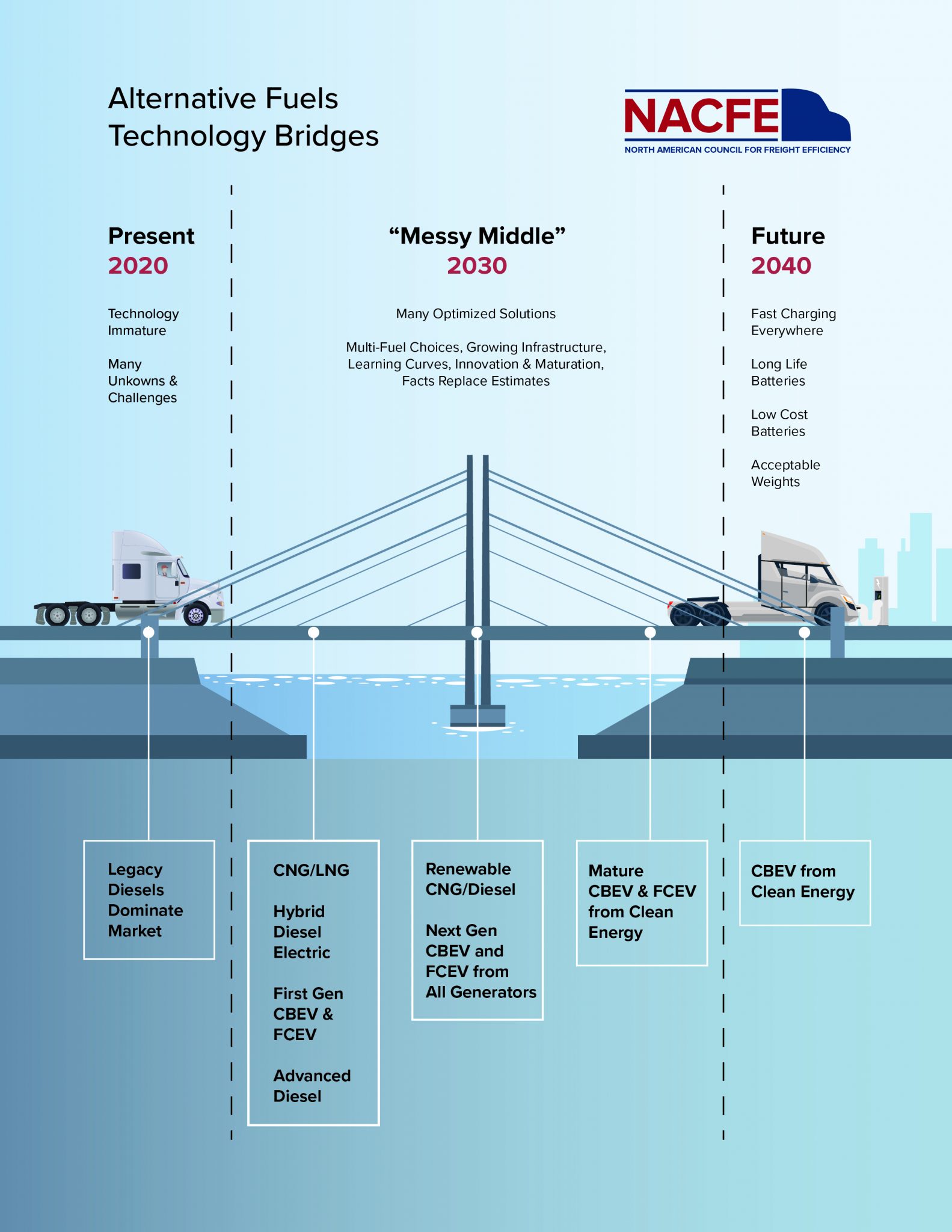

- There will be a “messy middle” until CBEVs and FCEVs alone power these trucks, as alternatives offer significant improvements over the diesel and gasoline baselines.

- A future zero-emission freight world will only have electric based vehicles (CBEV, FCEV, or catenary electric) powered well to wheel from truly renewable sources such as hydro, solar and wind.

Future Outlook

With growing levels of goods movement and increased pressure for cleaner transport, trucking is facing growing demand for near-zero or zero-emission solutions. As a result, the list of alternative fuels and related powertrains is growing, and these technologies are beginning to reach the point of production-quality vehicles. In the past, natural gas powertrains lead the way, but the bulk of the current investment is going into newer options like fuel cells and battery electric vehicles.

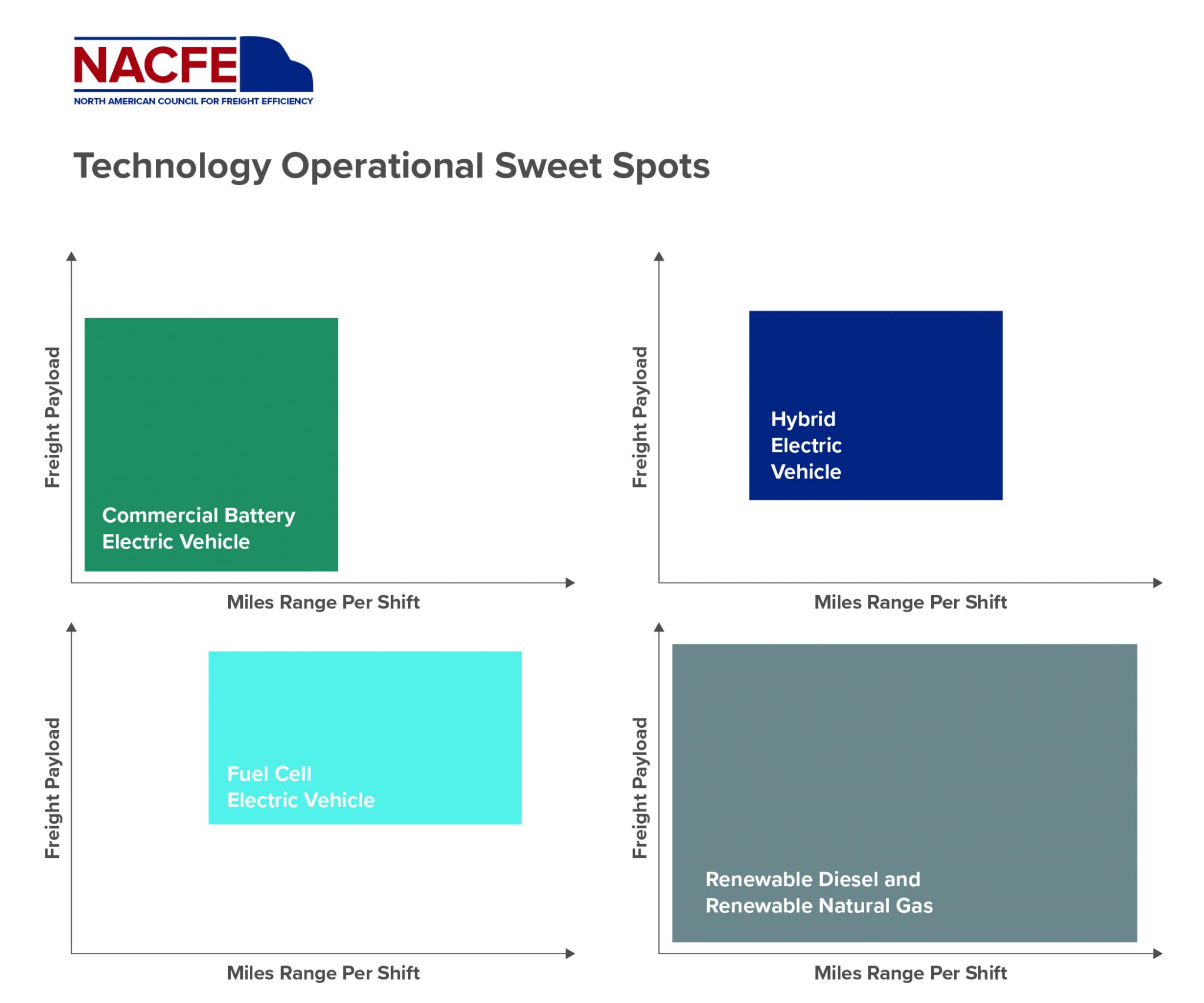

NACFE believes there is no single solution to replace diesel. Instead, specialization and regional factors are pushing the market to a “multi-fuel future” where many of these technologies will coexist.

NACFE concludes that in the long run, electric powertrains will predominate the marketplace due to the efficiency of battery electric powertrains for transporting freight when viewed from well to wheel. Through this transition, some technologies will emerge as “bridges” between the present and the future.

Decision-Making Tools

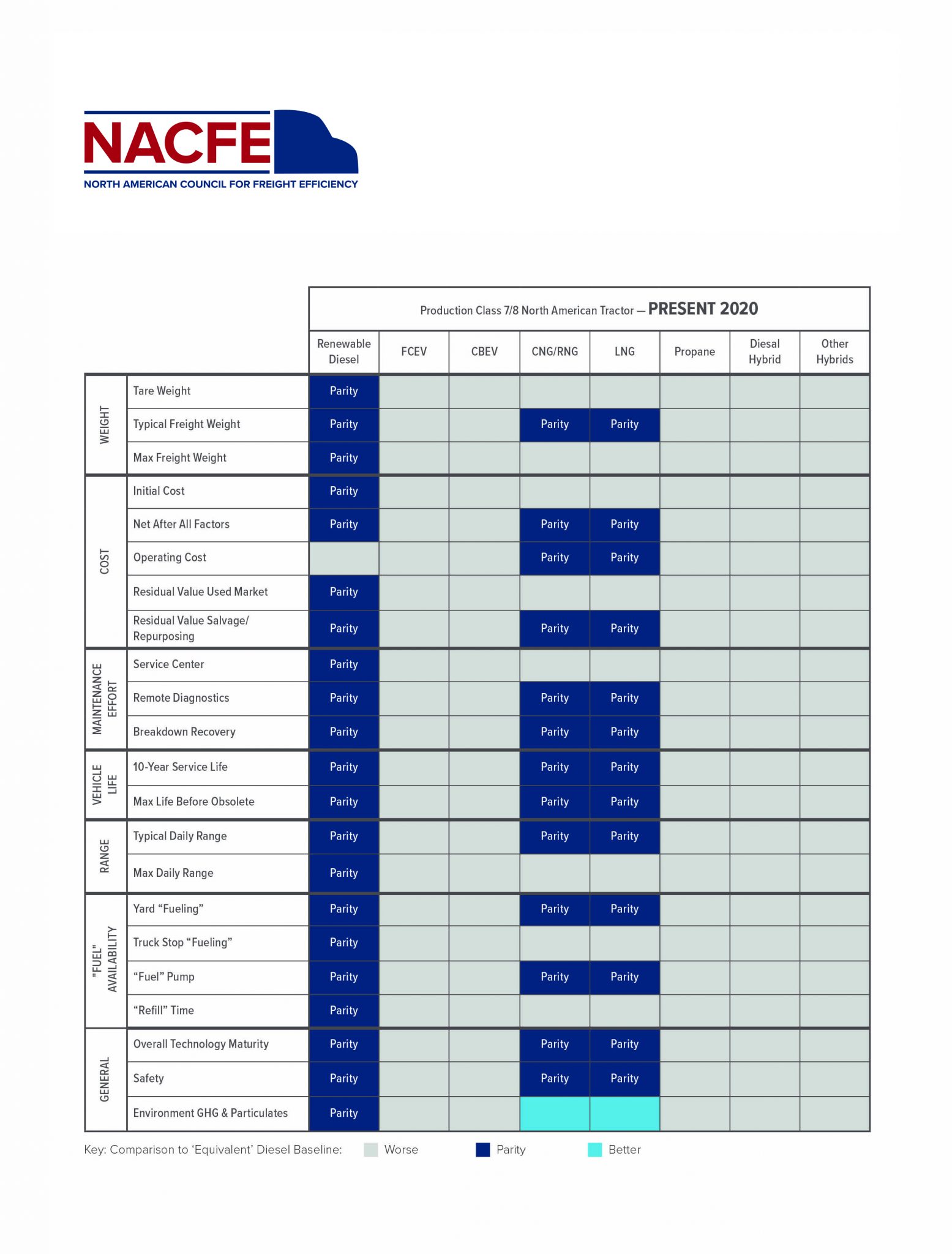

There are 22 parity factors related to comparing battery electric vehicles to current diesel vehicles. Using the alternative fuel powertrains outside of CNG/RNG and LNG vehicles.

Two charts show alternative fuel powertrain parity compared to diesel. One looks at the current situation and the other projects out to 2030.