NACFE Helps the Industry Navigate to Zero Emissions

Fully electric trucks, often referred to as commercial battery electric trucks, are reaching wider-scale consideration as truck, engine, and other component makers are developing the systems that will support such vehicles.

Battery and power-electronic development has progressed to make these trucks viable in certain applications. These trucks will have many benefits (more renewable energy, simpler design, etc.), but come with challenges (need for new infrastructure, development investments, etc.).

To date, NACFE has published eight Guidance Reports on a range of topics related to commercial battery electric vehicles and will continue to study developments in this rapidly changing segment of the trucking industry.

NACFE also has publish two Electrification Primers – one for fleets and one for electric utilities.

Intermodal & Drayage: An Opportunity to Reduce Freight Emissions

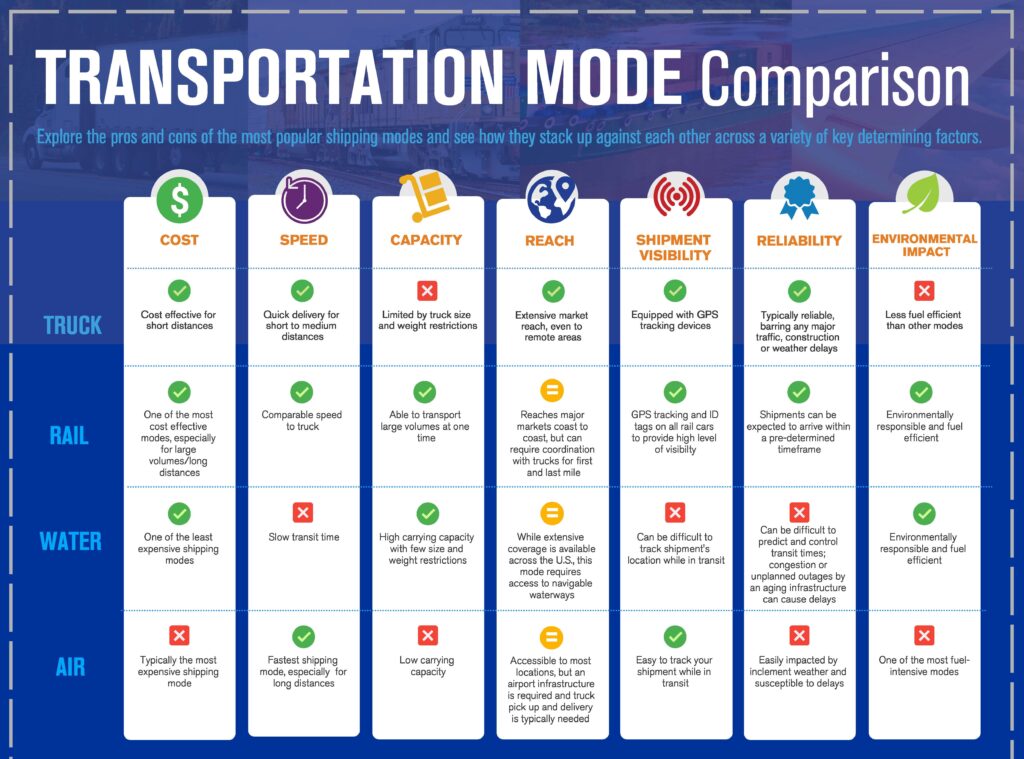

Ships, trains, planes, barges, trucks, even bicycles — odds are your latest package delivery traveled on all of these to get to you. Intermodal is not one mode preferentially used, but an integral system of modes working together to efficiently and reliably transport products from the point of origin to the consumer.

The market ultimately decides how it ships products. The market has been preferentially choosing trucking as a priority over intermodal, although rail has made some inroads on specific lanes. The explanation for the shift is complex. Many factors have contributed relating to service parameters such as time-to-market for shipped products, differences in in-process-inventory required for different modes of transport, reliability to deliver as scheduled, convenience, extent of customer-centric operation, and more.

While the potential is there for reduced net emissions through optimizing intermodal use, that opportunity has a great deal of complexity and history. The potential is real for intermodal operations using containers to be tools for reducing carbon emissions, however, there are also significant operational, economic and regulatory challenges versus alternative modes of transportation like trucking.

Understanding the future potential for rail intermodal transportation to reduce emissions requires some perspective on the history of railroads in North America. The story of trains is one of successes and failures in an endless pursuit of profitability. That pursuit has often impacted customer service metrics.

As new technologies enter production, such as battery electric and fuel cell electric powertrains, there is a significant potential to improve the environmental impact of both rail and truck transport. Interim energy solutions such as renewable natural gas, renewable diesel, and green hydrogen may also keep vehicles moving on internal combustion engines, while concurrently reducing the impact of their emissions as technologies and regulations evolve.

The opportunity to reduce emissions by proportionally moving more freight by rail versus trucks is a complex challenge. Increasing rail intermodal use by capturing market share from trucking’s long-haul segment would inherently increase regional and short urban haul truck market share.

Recommendations

As result of its work, the study team has identified three significant opportunities to reduce freight related emissions.

- Shift more market share from regional and long-haul trucking to intermodal rail.

- Replace traditional diesel drayage tractors with zero-emission and near-zero emission tractors.

- Replace traditional diesel terminal tractors with zero-emission and near-zero emission tractors.

Trucks are quicker than locomotives to transition to new technologies because the useful asset life of a truck may be less than 15 years whereas locomotives may have asset lives of 50 years.

However, the aging North American locomotive fleet offers opportunity to make significant steps in new zero-emission locomotive technology once it becomes available.

Increasing intermodal rail freight from long-haul on-highway operations on select routes can reduce net emissions, but the opportunity may be tempered if the required drayage trucking demands at both ends of the rail line have significant mileage requirements.

Rail must improve its customer service focus, refining on-time reliability and shortening time in transit to better compete with trucking.

Many trucking companies can share one highway, where most Class I rail lines are dominated by their primary owner. This leads to challenges in providing competitive rail services to customers located on or near those rail lines. Improved flexibility with reciprocal switching could increase customer demand for rail services through greater rail company competition.

Conclusions

Railroading and trucking are intertwined freight segments that both compete and complement each other. Both are viable alternatives for moving freight but differ in focus, with trucks generally being faster and more flexible. Railroads can offer lower costs and greater volumes on specific lanes.

- The competitive relationship between rail and trucking has seen trucking take the lion’s share of market. The two, however, are linked as shipping rates are tied to supply and demand on the two transportation modes. Greater use of one invariably drives volume done in the other and hence drives market rates down making them more attractive to shippers. If rail or trucking assets are operating at capacity, the other mode has opportunities to capture market share because the freight must move.

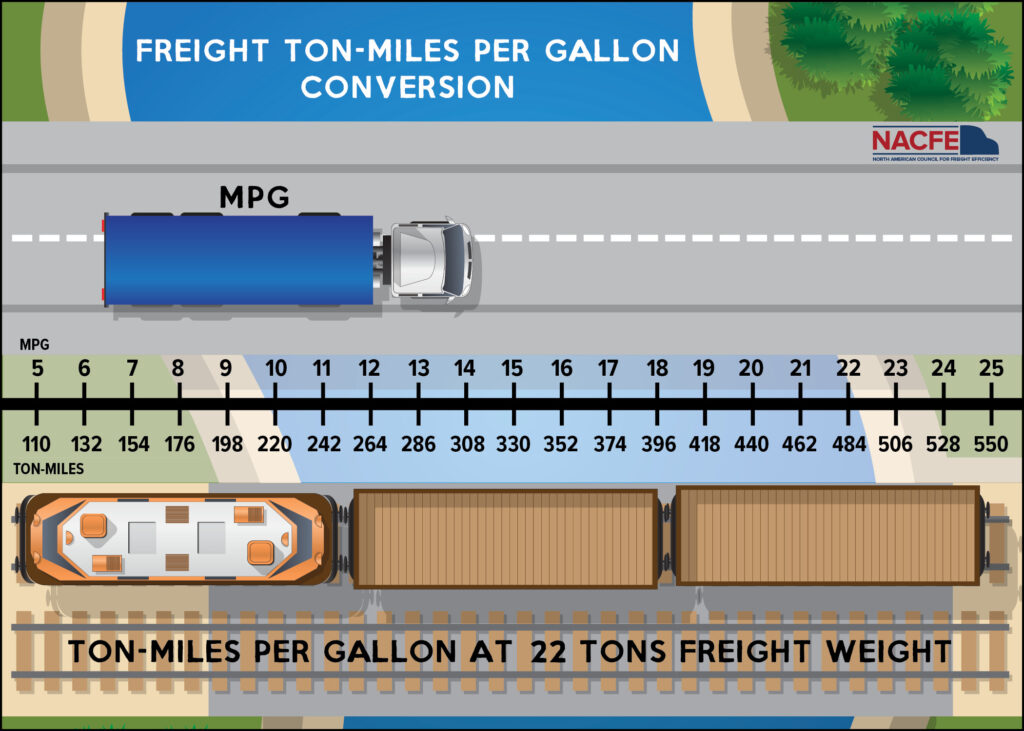

- Intermodal railroading and drayage trucking are a subset of the relationship between rail and trucking, wrapped inside the ubiquitous shipping container. Growth in intermodal rail operations inherently means growth in regional and urban short-haul trucking as trains do not go everywhere that trucks can. For this reason, predicting the net emissions benefits of greater intermodal use is much more complex than just replacing a long-haul truck with a train over a common distance.

- Intermodal terminals are not located everywhere. Six major Class I railroads have differing service networks in North America. Freight generally has to be moved both to and from these terminals by drayage trucks, and some of these may go extreme distances. Intermodal operations do not supplant trucks, they only migrate their usage to different routes and distances.

- Overly simplistic comparisons of emissions savings of using rail versus trucks abound. New low- and zero-emission technologies in trucking are also greatly shortening the emissions gap between rail and trucking.

- Intermodal rail combined with zero-emission drayage vehicles are capable in combination of reducing freight emissions versus traditional diesel long-haul trucking on specific shipping lanes but are not necessarily better on all lanes due to the trackage limitations and market segmentation of the six Class I railroads.

Charging Forward with Electric Trucks

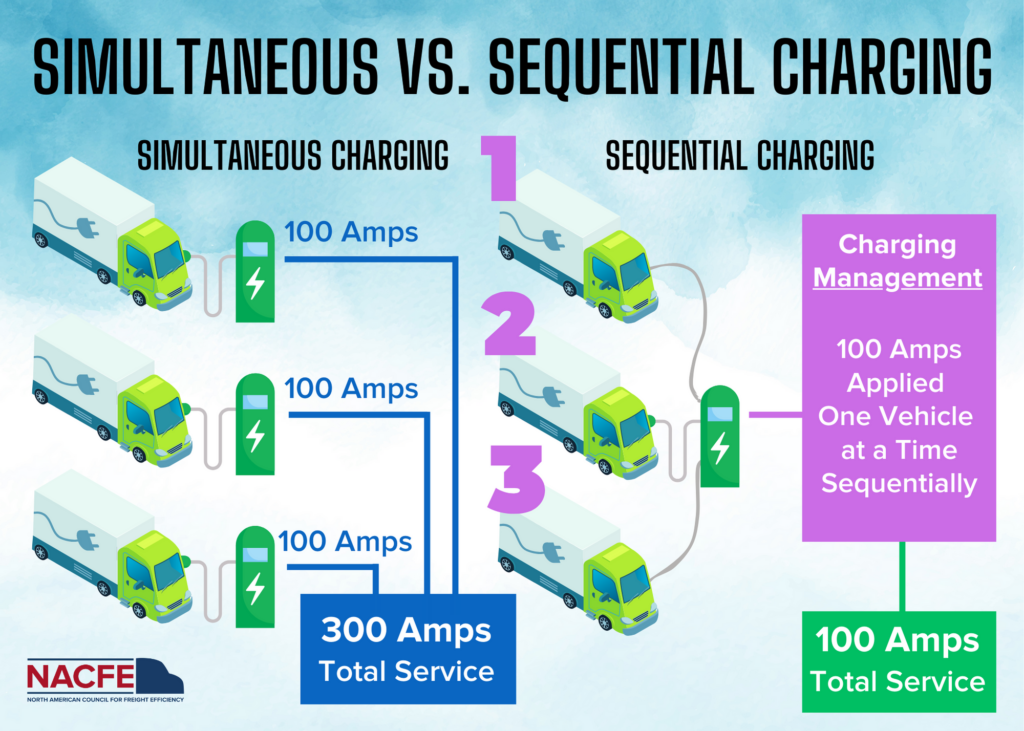

As fleets move from pilot testing battery electric vehicles (BEVs) to deploying them in their regular day-to-day operations, fleet managers are recognizing the challenges of charging electric trucks effectively and cost efficiently. Charging is fundamentally different from diesel fueling and requires an understanding of the physical charging infrastructure and the cost structure of electricity, and how the two interact. Fleets need to budget sufficient time and resources to understand truck charging basics, as they embark on the careful planning required to create a system that works best for them.

Fleets need to know how much energy they will need to keep their fleet operating, add a margin for uncertainty, and then design a charging system that can reliably deliver that power to their vehicles in the least expensive way.

Even if a fleet chooses a specialist firm to design and install their charging infrastructure, it is prudent to understand the elements of a successful charging infrastructure system.

Charging Infrastructure Basics

Fueling BEVs economically requires charging in a way that works with the economics of the electric grid: minimizing demand (the maximum rate which you are charging) and maximizing charging during off-peak, low-rate periods (the time of day you are charging). Charging infrastructure is a combination of:

- Hardware, including the number of charger plugs, their power levels, and the equipment to deliver that electricity, and

- Rigorous management, generally via software, of overall electricity demand and cost to provide the necessary amount of charge so the trucks can do their jobs at the lowest cost.

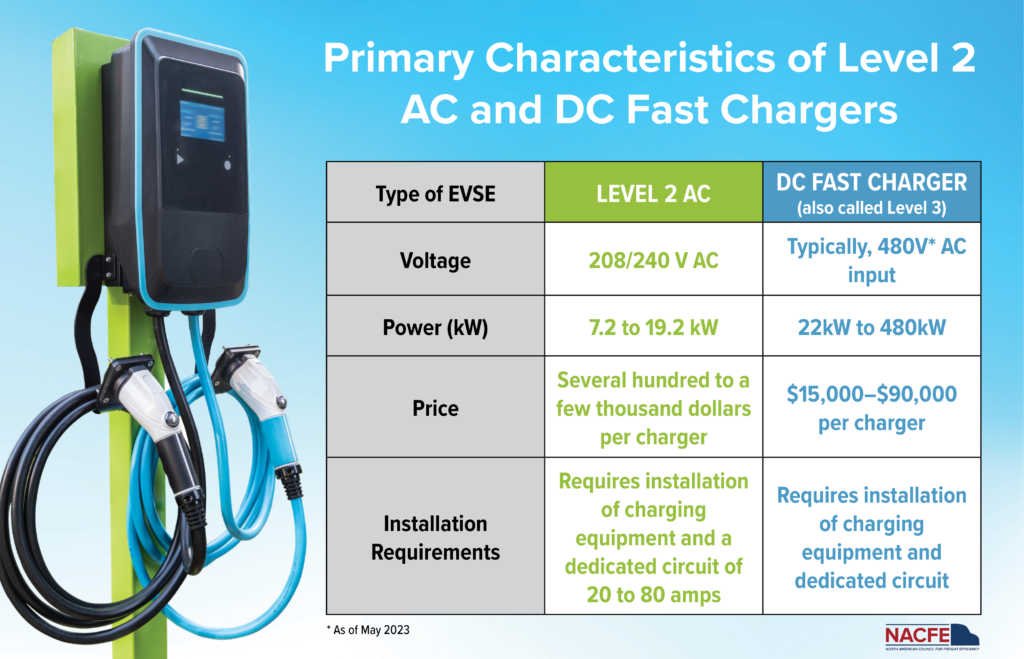

Fleets can choose from a variety of charger types to match chargers to their vehicle charging needs. Level 2 AC provides 208/240V AC at up to 80 amps to provide up to 19.2 kW of power and is sufficient for many commercial truck fleets, particularly those that use Class 3 through 6 vehicles, return to base, and are parked for a long period (e.g., overnight).

Level 3 DC charging, more commonly referred to as DC Fast Charging (DCFC), is a broad category of charging that delivers DC, rather than AC, electricity to the vehicle, eliminating the need for on-vehicle conversion from AC to DC. DCFC provides charging at up to 350 kW or higher.

Fleets need to select a set of chargers to provide the electricity they need in a way that minimizes overall total cost of operation, including capital cost for the infrastructure, cost for electricity, any associated equipment, and maintenance and repair costs.

Key things to consider with charging systems include electrical hardware, such as transformers, electrical switchgear, charger types, conduit and wiring asphalt, as well as concrete, trenching, striping, and landscaping required for installation, and charging management systems, networking, and maintenance contracts to ensure the equipment is used most effectively.

10 Steps to Implement Truck Charging

Creating and deploying an effective plan for fleet electrification requires considering many variables. While each project involves some bespoke engineering since each site and project is different, there are some common elements to successful infrastructure deployment.

- Assign an internal manager: Select someone to champion the project internally and work with all stakeholders

- Consult with key stakeholders early and often: This includes utility, landlord, AHJ, OEM, etc.

- Assess electrical service: Work with your utility and contractor to understand current service capacity, additional capacity needs, timelines and costs.

- Select electric vehicles: Choose vehicles based on your fleet’s usage, duty cycles, distance traveled, load characteristics, etc.

- Select chargers: Choose chargers based on fleet requirements, utility cost structure, and OEM’s recommendations.

- Assess Financing: Explore local, state, federal, and utility incentives, grants, and rebates as well as ownership models.

- Procure charging components: This includes hardware, software and service plan.

- Design site plan/permit the project: Consider hiring an engineering team.

- Construct charging infrastructure: Maintaining schedule is paramount, mitigating delays is a team effort.

- Commission charging hardware: Use authorized commissions agents for this step.

Conclusions

There are many factors that go into successfully installing an electric vehicle charging infrastructure. The study team offers the following recommendations on how to implement a successful charging infrastructure.

- Electric trucks and chargers must work together. Charging infrastructure is just one part of a system integrating your vehicle needs, electricity rate structure, and the timing and cost of bringing additional electricity to your site. Choose individual components only after designing the entire system, not only for initial implementation, but for potential future needs. Choose equipment with a track record for reliability and make plans for its maintenance. Not all chargers work well with all vehicles. Work closely with your vehicle manufacturer(s) as you select charging equipment. Expect the process to be iterative.

- Your utility is a key partner. Electric trucks use a lot of power, probably more than you currently have available. Your power usage will grow as your fleet’s use of BEVs grows. Determine how much power you need in both the short- and long-term to fully implement your plans. Learn how much power you already have on site to charge trucks, and how much more you will need to get beyond the pilot stage. It is essential that you meet in person with your utility as soon as you begin thinking about electric trucks, as they will be your partner in providing the power you need. Increasing power delivery to your facility can take time. Coordinate closely with your utility and modify your implementation schedule to assure you have power when you need it.

- Use and design greatly affect charging cost. Both AC and DC chargers are available in wide variety of power outputs and technologies appropriate for any vehicle. In general, spreading charging over the longest time and using lower charging power makes both the charging equipment and electricity costs lower and maximizes battery life. Design your charging strategy to make the best use of vehicles’ scheduled downtime. Charging management software can pay for itself by ensuring your vehicles are ready to roll when needed at the lowest cost.

- The transition requires staff and attention. The transition to BEVs and associated charging infrastructure requires attention and expertise. You need to have a single point of contact with internal and external authority and to lead the project. If your utility has a BEV team, reach out to them. Talk to other fleets and resources like your local Clean Cities Coalition. You may benefit from hiring an expert consultant at the start of your move to owning BEVS.

- Consider other charging business models. You may wish to explore options other than owning and operating your own charging infrastructure as a stopgap or long-term model. These include CaaS and TaaS. CaaS provides a contracted service to provide all your charging, either on your site or at a nearby shared location. TaaS adds the electric trucks to the CaaS offering. In addition, turnkey BEV infrastructure financing, design, installation, operations, and maintenance can be provided by specialized businesses.

- Other key considerations. There are a host of other things to consider when it comes to EV infrastructure as well as additional developments to be aware of.

- Grants, incentives, and subsidies are at an historic high, offering a window of opportunity for fleet electrification.

- If you do not own your facility, talk with your landlord early.

- Microgrids are emerging from the shadows.

- Reliability and interoperability of chargers must improve.

- Training a skilled workforce to support and service BEVs and charging hardware is critically important.

- Processes to improve electricity transmission/distribution infrastructure must be improved.

- BEV makers must increase miles per kilowatt, reduce vehicle costs and weight, and increase payload and reliability.

Hydrogen Trucks: Long-Haul’s Future?

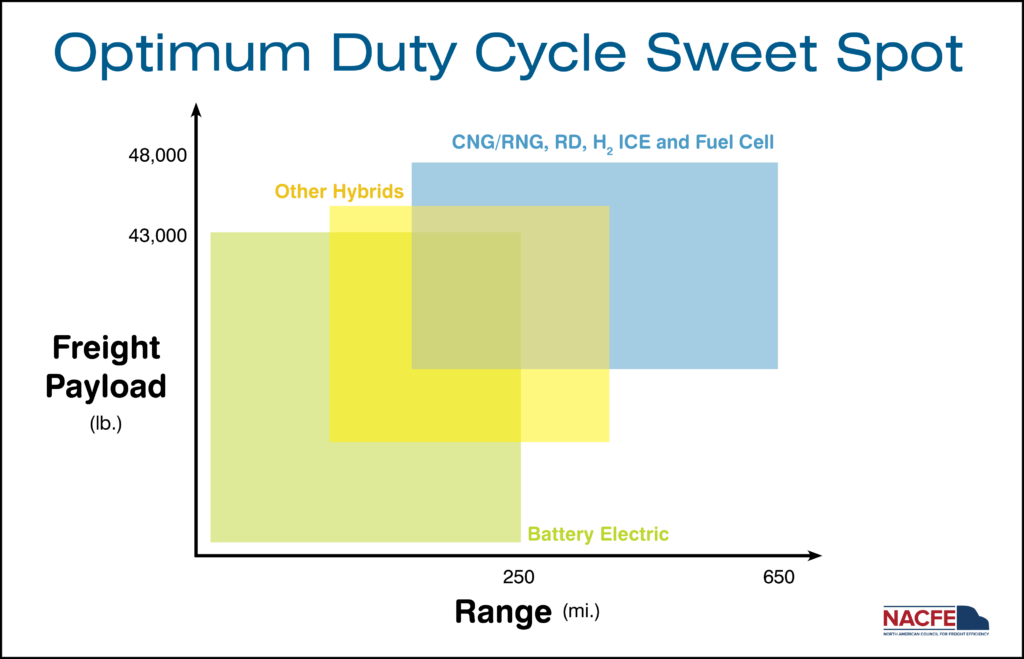

Hydrogen is entering the marketplace as an energy source for zero-emission long-haul trucking. Two paths are emerging, fuel cell electric and new hydrogen internal combustion engines. Hydrogen is not optimum for all duty cycles. Hydrogen fuel cell tractors are, however, the only viable zero-emission solution currently proposed for one-for-one replacements for diesel in the future of long-haul heavy-duty trucks.

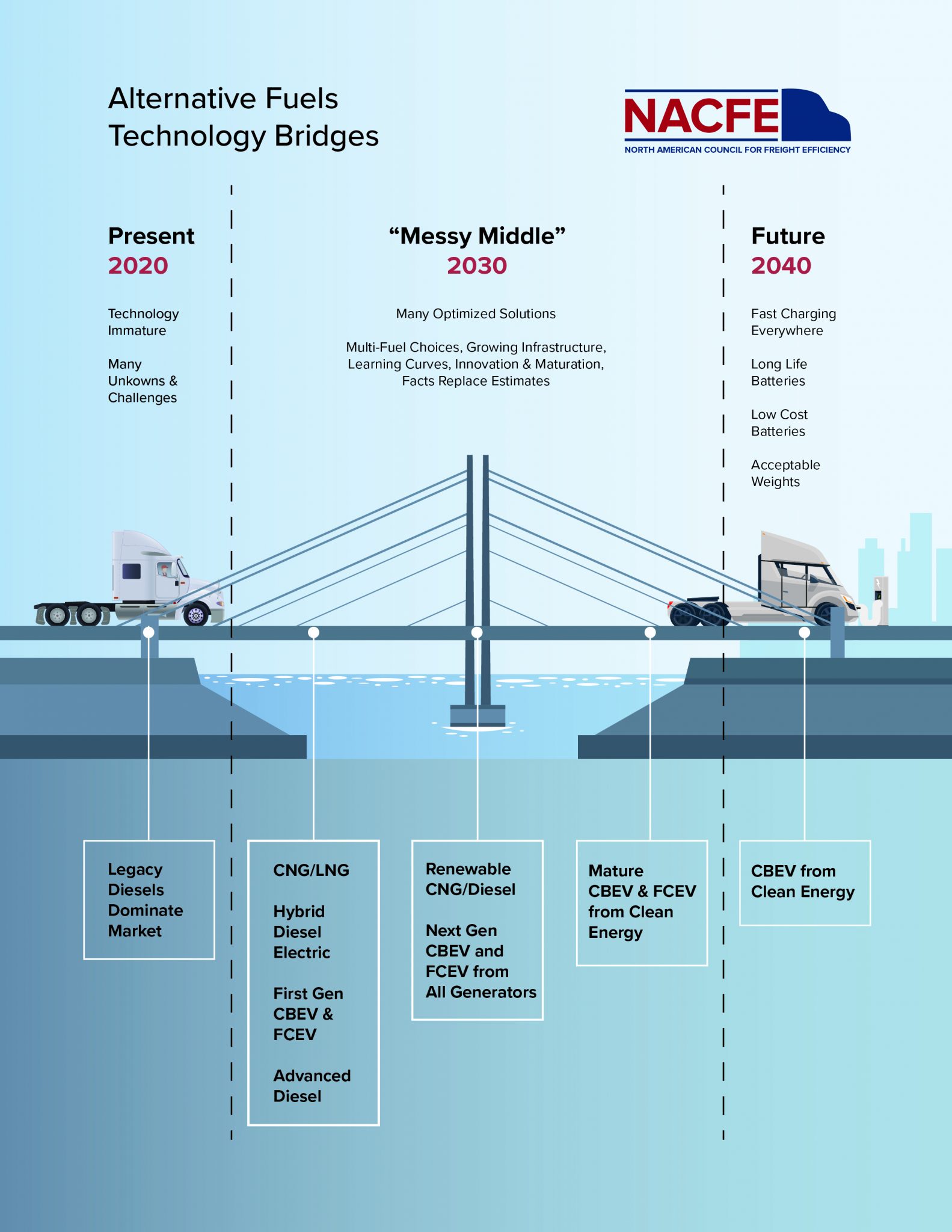

In December 2020, the North American Council For Freight Efficiency (NACFE) compared a range of alternative fuel heavy-duty truck technologies including hydrogen in a report and the following findings from that report are still valid.

- Hydrogen fuel cell trucks are just starting to see real-world use and their adoption is being driven by regional or national considerations that are much bigger than what exists for trucking fleets.

- Battery electric trucks should be the baseline for hydrogen fuel cell electric vehicle (HFCEV) comparisons, rather than any internal combustion engine alternative.

- As for all alternatives, fleets should optimize the specifications of HFCEVs for the job they should perform while expecting that the trade cycles will lengthen.

- The future acceleration of HFCEVs is likely not about the vehicles or the fueling but more about the creation and distribution of the hydrogen itself.

- Finally, the potential for autonomous fuel cell trucks to operate 24 hours a day adds significant opportunity for making sense of capital and operational investments in hydrogen.

NACFE forecasted trends in state and federal regulations that could hasten hydrogen adoption, however, the period 2021 to 2022 has seen significant acceleration of state and federal efforts.

Other issues that need to be considered for hydrogen to be a viable fuel option for commercial vehicles:

- Hydrogen economy cannot be built solely on the shoulders of long-haul trucking, as there simply is not enough there to get the scale needed for cost reduction.

- Standardization will be critical to get volume cost reductions on designs of tanks, fuel systems, fuel cells, batteries, cables and connectors, etc. Individual

- The pace of innovation, investment, regulation and awareness of hydrogen as a heavy-duty truck fuel has increased.

- The oil industry significantly stepped-up publicizing and marketing their efforts to lower emissions. The sea change in the oil industry to pursuing zero-emission markets is significant, reinforcing a path toward hydrogen as a fuel in trucks hauling freight.

- Infrastructure investments and regulatory efforts are also impacting the development of hydrogen as a fuel for medium- and heavy-duty trucks.

- There has been development of hydrogen internal combustion engines that presents a near-zero emissions vehicle that has the capability of going longer distances with shorter refuel times and weighing less than a battery electric vehicle specified to do the same job.

- Green hydrogen production infrastructure projects are being developed and Significant funding is being allocated to hydrogen freight projects.

What People Are Saying

Most countries have committed to decarbonize and experts acknowledge and agree that hydrogen is necessary for decarbonizing the grid, so it is inevitable that low carbon hydrogen will be available.

— Alan Mace, Product Applications Manager, Ballard Power Systems

As we move to the zero-emissions freight future, in the long run, there are only two choices of power – battery electric and hydrogen fuel cell.

— Rick Mihelic, NACFE Director of Emerging Technologies

Hydrogen technology is coming faster than we expected. We will be testing a truck this year.

— Rob Reich, Executive Vice President, Chief Administrative Officer, Schneider

Findings

Hydrogen will be a factor in future long-distance freight hauling in combination with battery electric vehicles for shorter range operations. Here are key findings from the report.

- Hydrogen powered freight is required for a zero-emission freight future.

- There is a significant amount of funding going toward establishing the basis for a hydrogen economy that includes long-haul freight transportation.

- The cost of hydrogen production, transportation storage and dispensing will not be cost competitive with diesel without significant assistance from tax credits and other subsidy mechanisms.

- Managing the actual retail cost of hydrogen is perhaps more important than continuing discussion of reducing the production cost at the hydrogen plant.

- Hydrogen is closely tied to electricity. You can’t have hydrogen without significant amounts of electricity.

- Hydrogen is a significant factor in federal, state and local planning and regulations for the zero-emission freight future.

- Purpose-built hydrogen trucks optimized for specific duty cycles may not be valued well in the secondary market, leading first owners to keep the vehicle until it is salvaged.

- Hydrogen costs decrease as the scale of the hydrogen plants increase. Large production requires multiple industries to increase demand for hydrogen. Trucking alone is insufficient to reach demand scale needed to justify large hydrogen plants.

- Hydrogen used for creating alternative fuels like renewable diesel will reduce net emissions but at the cost of delaying adoption of zero-emission alternatives.

- All the answers do not need to be known on day one of hydrogen. Production supply and market demand will evolve in lock step over time. Innovators will find market opportunities where there is an oversupply of hydrogen, creating new market demand.

- Hydrogen and electricity supply are inherently resilient as there are multiple methods of producing them, leading to competitive forces mitigating price and supply volatility.

Conclusions

Hydrogen for use in freight transportation is just in its infancy. NACFE developed four significant conclusions about hydrogen as a fuel source for commercial vehicles.

- Hydrogen and battery electric are not an “either/or” but an “and” for the zero-emission freight future. Battery electric vehicles will inherently be the most economical and efficient choice for shorter distance zero-emission duty cycles, and hydrogen will be the only viable economic choice for long-haul zero-emission duty cycles. Ultimately fleets in the market will make decisions on which technology succeeds for which duty cycles.

- Hydrogen fuel cell tractors are the only zero-emission solution for many heavier, longer distance duty cycles for heavy-duty tractors. Significant cost reduction across all cost elements is needed for these tractors to be cost effective. Supply chain companies from shippers, to carriers, to fuel suppliers and others along with government assistance, must share in higher costs for the benefits of zero emissions.

- Alternative fuels like RNG, renewable diesel, and hydrogen used in internal combustion engines will be required to support the transition in the next two decades to help make progress toward zero-emission goals, while in parallel ramping up the hydrogen and battery electric infrastructure and manufacturing base.

- Industry agreement is needed on whether hydrogen long-haul fuel cell tractors and the transport of the hydrogen fuel itself, will be based on gaseous or liquid hydrogen. This is a core factor that can impact multiple infrastructure and manufacturing systems, and significantly impact market penetration and volume estimates for cost reduction potential.

Charting the Course for Early Truck Electrification

To gain insights into trucking electrification, RMI, Geotab and NACFE teamed to gain insights into which segments of the trucking market can be electrified first and what charging infrastructure will be required to enable that transition.

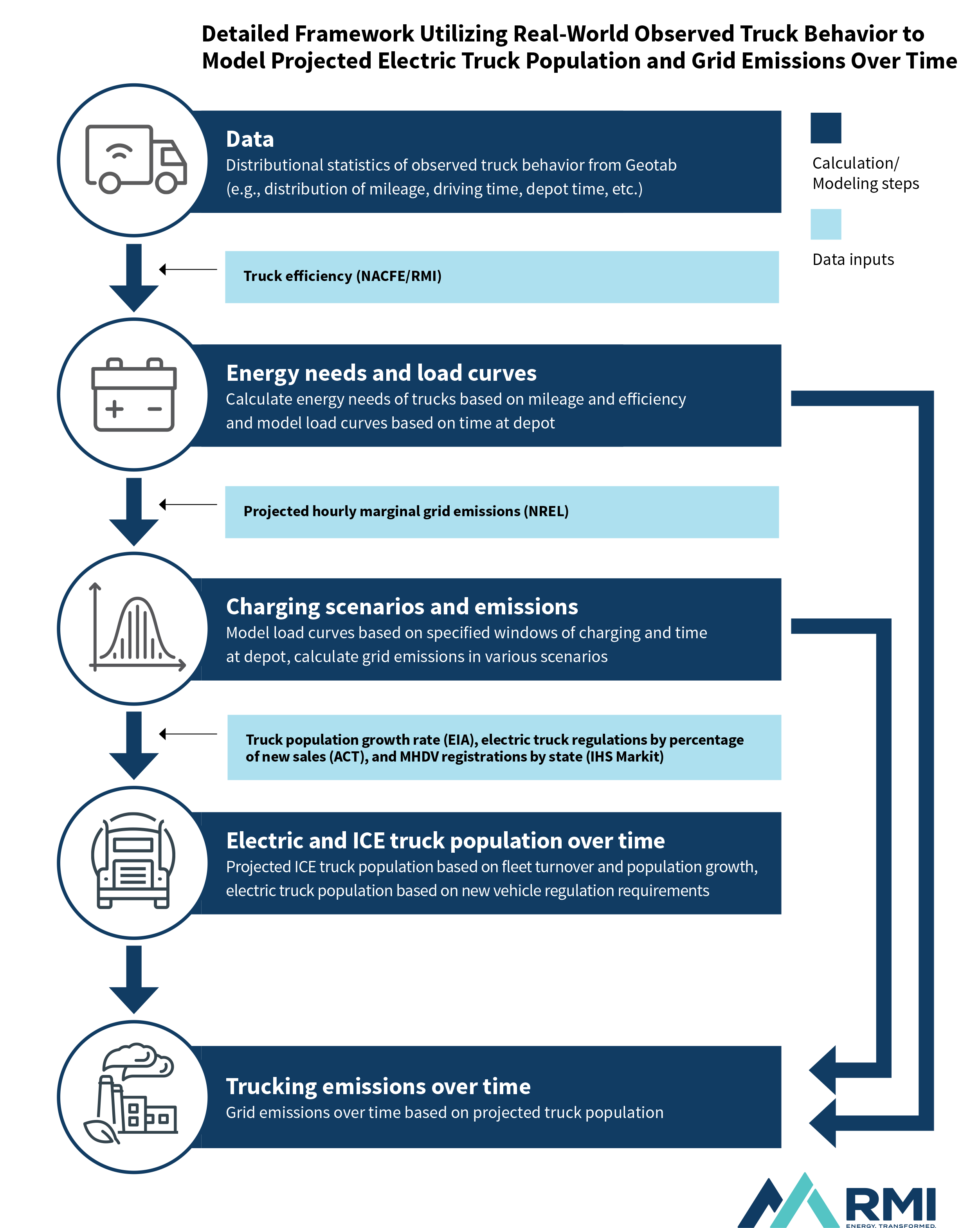

The study team used vehicle telematics data from Geotab to understand the behavior of medium- and heavy-duty trucks. Although the data provided by Geotab for this analysis is exclusively from trucks powered by internal combustion engines (ICE), the observed driving patterns of these vehicles can be used to determine which trucks could be replaced by EVs the soonest based on existing EV technology and charging infrastructure.

To estimate the charging needs and impacts of trucking electrification, the study team developed a multistep modeling framework. Two scenarios for fleet electrification were analyzed: one with an average vehicle replacement age of 15 years, and a second with an average vehicle replacement age of 10 years.

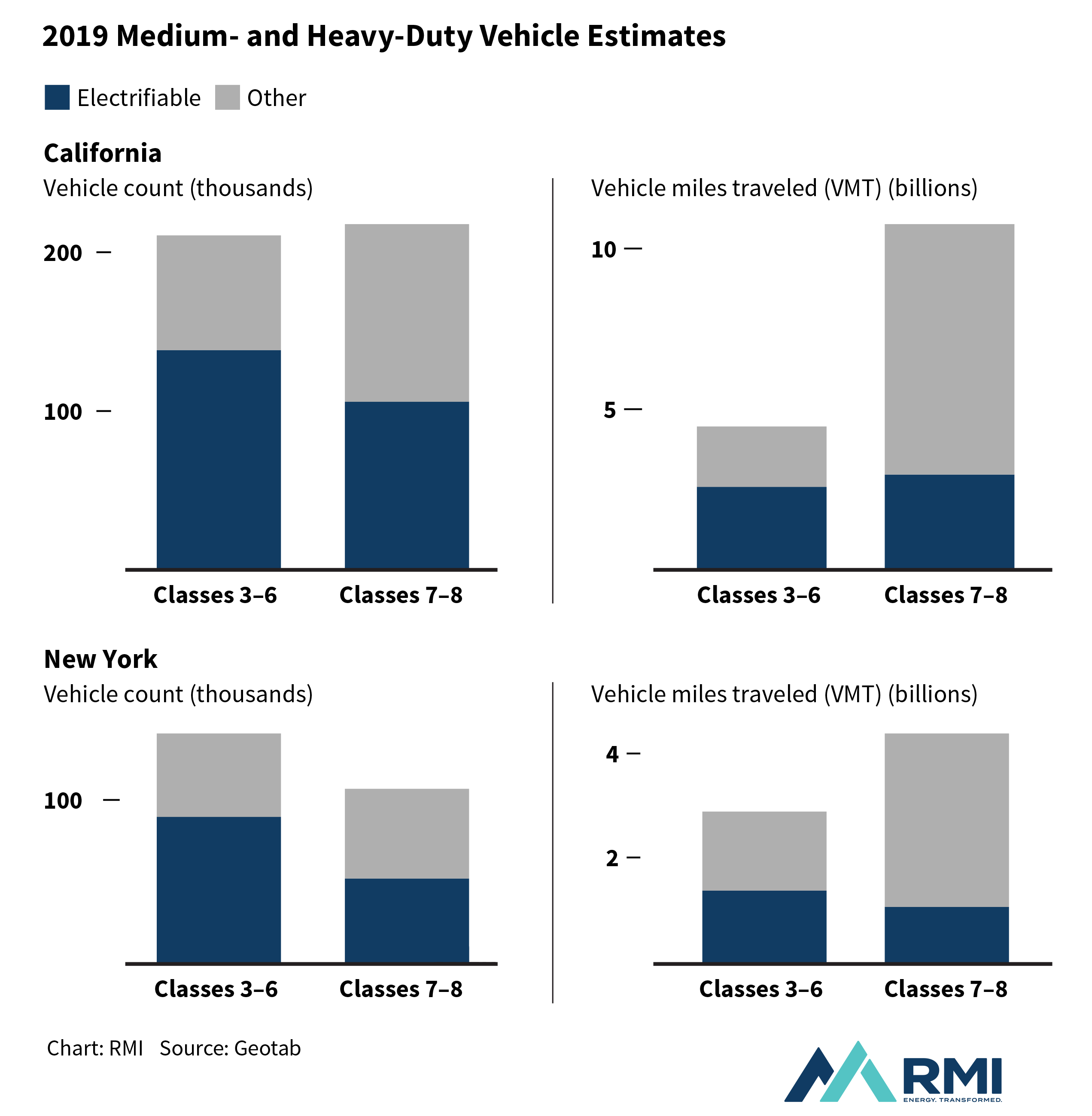

The report determined that, based on how vehicles are driven today, approximately 65% of medium-duty trucks and 49% of heavy-duty trucks (stationed in California and New York) are electrifiable, meaning they could be replaced with EVs based on current technology. These vehicles are responsible for about 30% of the vehicle miles traveled by trucks based in the two states.

Trucking electrification is only possible if vehicle charging is available. Based on the report team’s analysis, the electrifiable trucks in the dataset would require on average 50 to 400 kilowatt-hours per day — comparable to the electricity used by 2 to 14 homes. This amount of energy is generally less than or equivalent to one full charge of the truck’s battery, based on electric truck models currently on the market. Electricity demand from truck electrification may decrease as e-MHDV models begin to require fewer kilowatt-hours per mile and fleets and drivers learn to optimize regenerative braking and other driving behaviors to achieve maximum efficiency.

Key Findings

Based on results from the analysis the study team came up with some key takeaways.

- With existing technology, many trucks can be electrified and continue to perform similarly to ICE trucks. For trucks domiciled in California and New York, we found that 65% of medium-duty trucks and 49% heavy-duty trucks are electrifiable today. As electric truck ranges increase and public or shared truck-charging infrastructure becomes available, even more of the ICE trucks on the road today will be electrifiable.

- Electric trucks, regardless of when they charge, offer significant greenhouse gas emissions reductions per mile compared with diesel vehicles. Considering the quantity of emissions associated with freight movement in North America, the potential reductions resulting from electrification provide an unmissable opportunity.

- Given demand charges and high infrastructure costs, incentives, policymakers, regulators, and utilities should encourage fleets to charge at lower power levels over longer periods of time. Charging at lower power levels outside of peak grid demand times is the best strategy for minimizing both capital and operational expenses related to charging.

- Utilities will need to provide rate structures that allow medium- and heavy-duty trucks to electrify economically. Using big trucking datasets, such as the one discussed in this report, can help utilities understand the large-scale impacts of their rate structures on fleet electrification.

- Fleets will require support. Managing electric trucks represents a steep learning curve, particularly regarding optimal charging strategies. Utilities should participate in truck electrification by offering fleet customers free or low-cost advisory services to co-develop charging strategies that minimize overall charging costs, which will benefit both the grid and fleets.

High Potential Regions for Electric Truck Deployments

Regional haul, heavy-duty trucking operations are good candidates for electrification due to the segment’s relatively short-hauls and return-to-base operations. Many early electric truck deployments have taken place in California, but as the market matures, fleets, utilities, manufacturers, policymakers, charging companies, and other industry stakeholders are seeking assistance to prioritize regions outside California for future deployments of this technology.

The Guidance Report proposes a three-part framework that the industry can use to prioritize U.S. and Canadian regions for electric truck deployments:

- Technology – Identify the regions that are most favorable to the unique attributes of the technology itself.

- Need – Identify the regions that exhibit the greatest need for the technology.

- Support – Identify the regions that provide the most support for the technology.

In evaluating each of these criteria, fleets should consider not just which regions are best suited for electric trucks, but which represent the strongest competitive advantage over diesel trucks.

In considering where to deploy electric trucks, there’s a lot to think about – everything from charging infrastructure to which climates the technology operates the best in to where the most funding and incentives are available. This framework helps not just fleets, but utilities, OEMs, policymakers, and others think through the many considerations to ensure that wherever they deploy electric trucks that they’re a success.

– Patrick Browne, Director of Global Sustainability, UPS

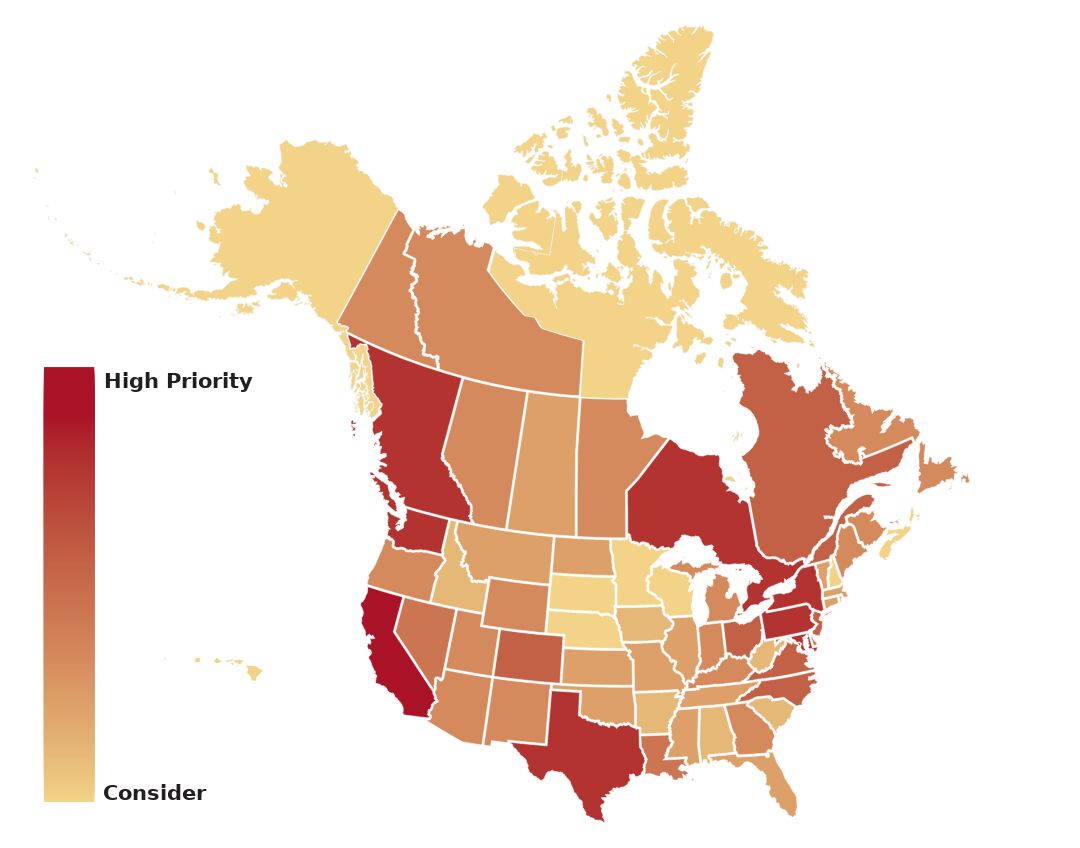

NACFE performed an initial analysis of where the three criteria intersect to create a “hot spot” for near-term regional haul electric truck deployment. A heatmap was developed to identify those regions fleets should consider to be the highest priority for electric truck deployments.

Key Findings

- Regions favorable for electric truck deployments are found across the U.S. and Canada.

- The Northern California, Southern California, Texas Triangle, Cascadia (stretching from Portland, Oregon through Seattle and into Vancouver, Canada), Colorado Front Range, Northeast U.S., Greater Toronto Area, and Greater Montreal show particularly high potential.

- Many trucking operations are not confined to individual provinces or states, and as such, fleets should think about electric vehicle deployments at the regional level.

- Policies and incentives to support electric truck adoption vary drastically by region.

- Policymakers and advocates looking to increase adoption of medium- and heavy-duty vehicles in their regions should consider which of the framework criteria they can change.

- This analysis identifies the regions with the highest potential for regional haul electric trucks now. As the technology develops further, we expect even more regions to favor electric trucks.

- Fleets should work with policymakers, regulators, utilities, and other stakeholders in their region to collaboratively develop strategies to advance zero-emission trucks.

Recommendations

- Support Deployments of Electric Trucks – Collect real world data and lessons learned from initial deployments to refine both the framework and the analysis.

- Expand Analysis to Other Geographies – Using the framework outlined in the report, conduct similar analyses for locations outside the U.S and Canada.

- Conduct Analysis at Smaller Scale – Allow for more granular data relevant to smaller scale areas – such as utility territories, metropolitan areas, key trucking corridors, or census tracks – by performing analysis with more fine-grained resolution.

- Share Results with Policymakers – Present analysis and findings to policymakers to help inform plans for trucking electrification in their jurisdiction. Help identify opportunities and address challenges.

- Analyze Economic Development Opportunities – Conduct analysis of economic development opportunities for high-priority regions, including jobs, new supply chains, and local manufacturing.

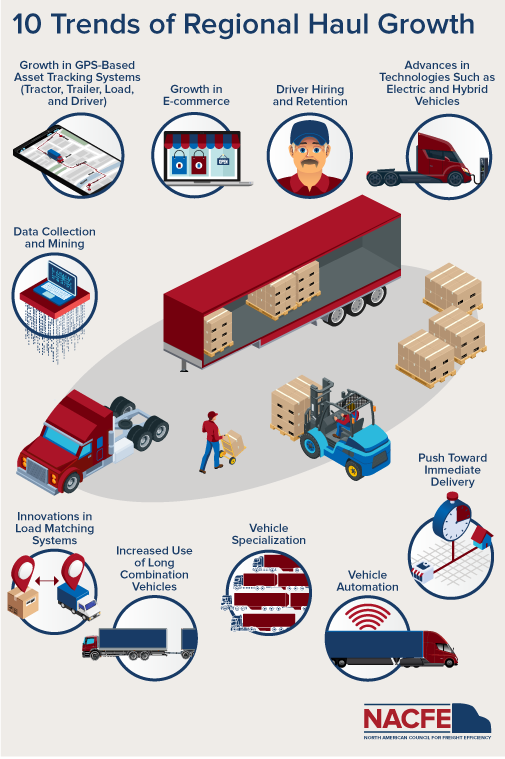

Electric Trucks: A Regional Haul Report

Research has shown us that regional haul is an important segment of the trucking industry and also one that makes sense for electrification, given its short-haul nature and return-to-base operation. As a result, NACFE is embarking on a three-year project to gain a better understanding of how commercial battery electric vehicles fit into the regional haul market. This work will be done in partnership with the Rocky Mountain Institute to leverage their expertise and industry network in power generation and the electrical grid.

NACFE is being aided in its efforts by funding from Hewlett Foundation, a nonprofit, private charitable foundation that advances ideas and supports institutions to promote a better world; and ClimateWorks Foundation, a non-governmental organization that is committed to climate action.

Our work will include:

- Identifying high-potential regional trucking routes

- Supporting implementation of first- and next-mover deployments

- Scaling of best practices in infrastructure deployment

- Increasing confidence in the value of electrification

Following the 2019 Run On Less Regional demonstration, several organizations partnered with NACFE to analyze the data collected. National Renewable Energy Laboratories (NREL) worked with NACFE to create a report on the applicability of electric trucks in these duty cycles:

“Battery Electric Powertrains for Class 8 Regional Haul Freight Based on NACFE Run-On-Less”

Ballard coauthored a white paper on how these duty cycles would fit into a hydrogen fuel cell truck:

Electric Trucks: Where They Make Sense

Battery electric commercial vehicles are here today and are a growing alternative to traditional diesel, alternative fuel, and hybrid powertrains. Electric trucks are a daily staple of media, conferences, factual research, and hype. Opinions vary considerably about whether this technology is a viable alternative to traditional diesel powertrains.

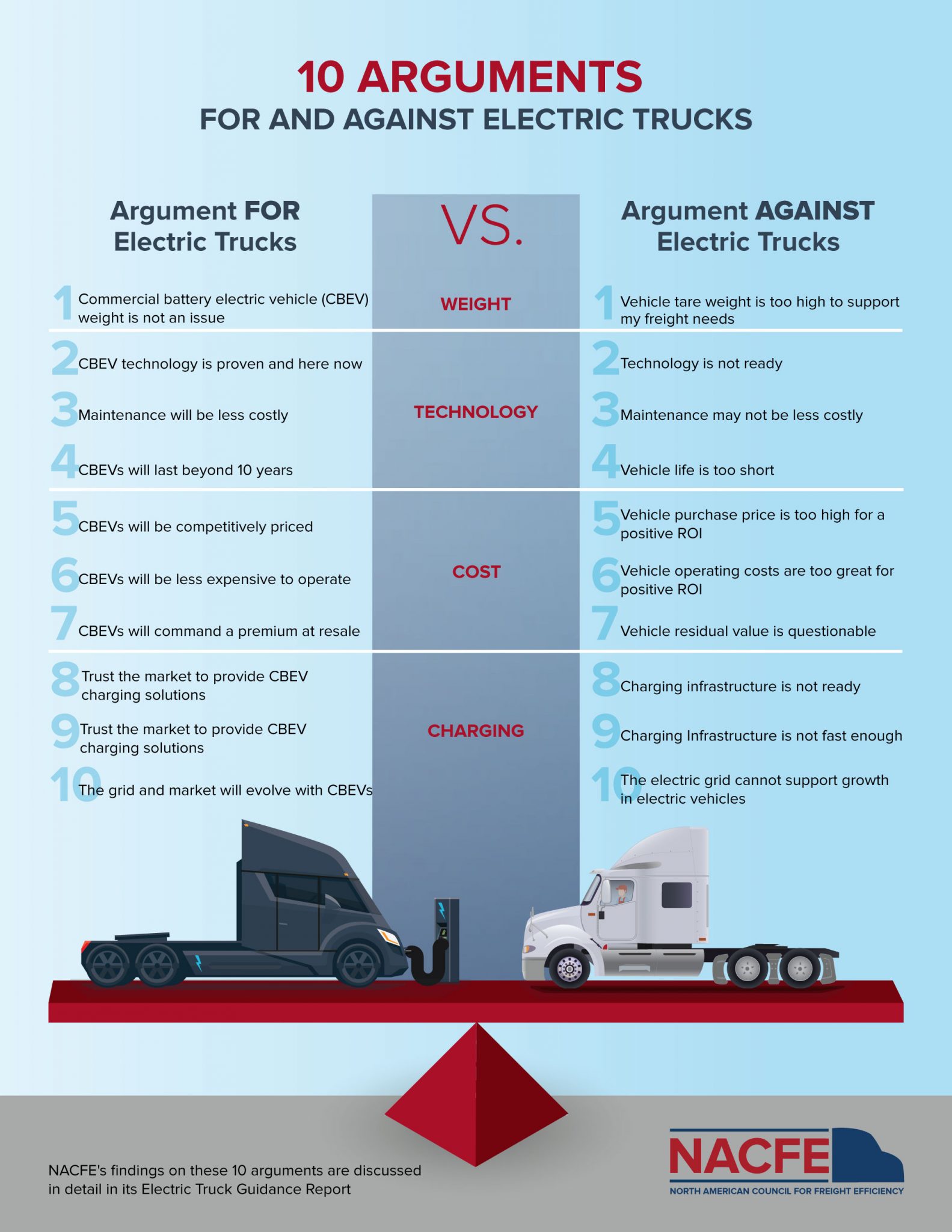

There are some common themes/arguments both for and against Class 3 through 8 commercial battery electric vehicles. They fall into several broad categories: weight issues, cost issues, and charging/electric grid issues.

This Guidance Report provides a foundation for understanding the key arguments for and against this rapidly evolving powertrain alternative.

More specifically here are the 10 common themes or arguments both for and against electric trucks.

Arguments

Vehicle tare weight is too high to support my freight needs vs. BEV weight is not an issue:

Competitive vehicle tare weights are possible in all classes for many duty cycles. Diesel powertrains also include fluids, emissions systems, exhaust systems, cooling systems, mountings, etc. that in total represent a significant weight reduction when removed. Typical payloads in many applications are well below maximum GVWR. The combination of both of these factors allows for BEV solutions with equivalent freight carrying capacity in many applications, but not all.

Charging infrastructure is not ready vs. rust the market to provide BEV charging solutions:

Off-shift charging of vehicles is possible today with existing systems. The challenge is high speed charging. BEVs needing sub-30 minute charging speeds require high capacity production charging systems that today are only in the conceptual phase. Fleets with well-defined one-driver shift A-B-A, or A-B-C-A type routes, for example, are well positioned for base depot charging. Even fleets with routes between hubs, if range is sufficient, could have charging at both ends of the trip. Fleets with variable routes and no guaranteed return trips will need growth in remote charging capacity before considering replacing diesels with BEVs.

The electric grid cannot support growth in electric vehicles vs. the grid and market will evolve with BEVs:

The market penetration rate of battery electric commercial vehicles will be on decade’s time scale. The United States has energy production capacity for significant volumes of electric cars and trucks. Adding vehicle charging stations to a warehouse or factory is like adding a new line; a process utilities regularly perform for commercial sites. High-rate charging expected for any sub-30 minute charging of commercial vehicles does create a significant demand on the grid. Alternatives to mitigate this through leveling and storage systems are being considered.

Vehicle purchase price is too high for a positive ROI vs. BEVs will be competitively priced:

Investment in BEVs may require quantifying the true total cost of ownership of both diesels and battery electric vehicles by including so-called intangible “soft costs,” liability costs, indirect costs and opportunity costs buried in overhead or ignored in traditional ROI calculations. Industry pricing of BEVs is still largely ill defined. Pricing experience is largely based on prototype and pre-production experience and estimation. There are many variables including grants, tax breaks and incentives and a largely unknown residual or salvage value. The industry is also developing alternatives to traditional purchasing or leasing. The trend over the last decade is expected to continue with large reductions in cost and significant gains in performance. Diesel performance, in contrast, is unlikely to yield large gains in performance with reduced costs.

Vehicle residual value is questionable vs. BEVs will command a premium at resale:

Introduction of electric vehicles has most of them still within their first owner’s use. The used electric vehicle is in its infancy. Residual value is a question. The value of electric motors and batteries in salvage may prove an advantage as they can be repurposed for non-vehicle uses and may have significant life left. Mechanical systems at the end of vehicle life require reconditioning which can reduce their net value in salvage.

Technology is not ready vs. BEV technology is proven here and now:

Multiple new companies are entering the US market with models ranging from Class 3 to Class 8. Established OEMs have been developing prototypes for field testing in specific markets. Automotive and bus battery electric vehicles have been in production for years and advancing on their learning curves in real world use. Battery capacities are expected to increase and charging time, cost, and weight are expected to decrease. The technology is on the steep part of the development S-curve, where big improvements are regularly expected.

Charging infrastructure is not fast enough vs. trust the market to provide charging solutions:

The speed needed for charging depends on each fleet’s duty cycles and daily and weekly route scheduling. Fleets that require sub-30 minute charging will need practical commercial vehicle capable charging technology to catch up to their needs.

Maintenance will be more costly vs. maintenance may be less costly:

Automotive experience with BEVs suggests maintenance of production designs should be on par or better than equivalent ICE powertrains. Prototypes and pre-production models generally see high infant failure rates and are managed more intensely, so the experience there is not representative of production units in normal field use. Long warranty periods promised by BEV manufacturers may reduce fleet financial risks on maintenance projections for commercial BEVs, but warranties do not alter truck potential downtime impacts.

Vehicle operating costs are too great for positive ROI vs. BEVs will be less expensive to operate:

Operating costs can be less for BEVs. The electric drives are more energy efficient than diesels. The reduction in diesel-based friction-sensitive mechanical systems such as pumps, valves, transmissions, and belts should reduce maintenance and servicing. The track record to date is mixed because much of the truck experience has been through first generation products in small numbers and in prototypes. These early vehicles were expected to have higher failure rates.

Vehicle life is too short vs. BEVs will last beyond 10 years:

NACFE’s discussions with fleets, OEMs, and suppliers is that they expect a Class 3 through 8 vehicle life of seven to 10 years before major refurbishing or salvage. With BEVs the battery packs are the most common concern expressed. The manufacturers expect the battery packs to be replaced when they reach 80 percent of their initial capacity. NACFE projected the frequency of recharging events based on automotive experience and determined that batteries will likely exceed the seven to 10 year vehicle life. The fleet’s specific duty cycles and environments need to be evaluated when researching BEV choices.

What People Are Saying

There is no one right solution that fits all fleets.

— Mike O’Connell, PepsiCo

Cummins wants to provide the “right product for every customer. There is no predetermined answer for them.

— Tim Proctor, Cummins Inc.

The explanation of arguments for and against BEVs is a great way to explain where the opportunities and issues exist. The question of weight and freight carrying capacity was really compelling and presented in a balanced, logical manner.

— Mel Kirk, Chief Technology Officer, Ryder System, Inc.

BEV comparison to diesel powertrains is not a simple yes/no choice. There are multiple factors, time frames, and cost/benefits to consider. And NACFE is committed to helping the industry sort through where BEVs make sense.

— Dennis Heathfield, NA On-Highway Field Sales, Cummins Inc.

There are many predictions about electrification. The reality is for the foreseeable future we will need a range of power solutions to provide fleets with the best opportunity for meeting their needs. NACFE sheds light on many of the complexities that will impact the rate of electrified power adoption in commercial trucks.

— Julie Furber, Executive Director – Electrified Power, Cummins Inc.

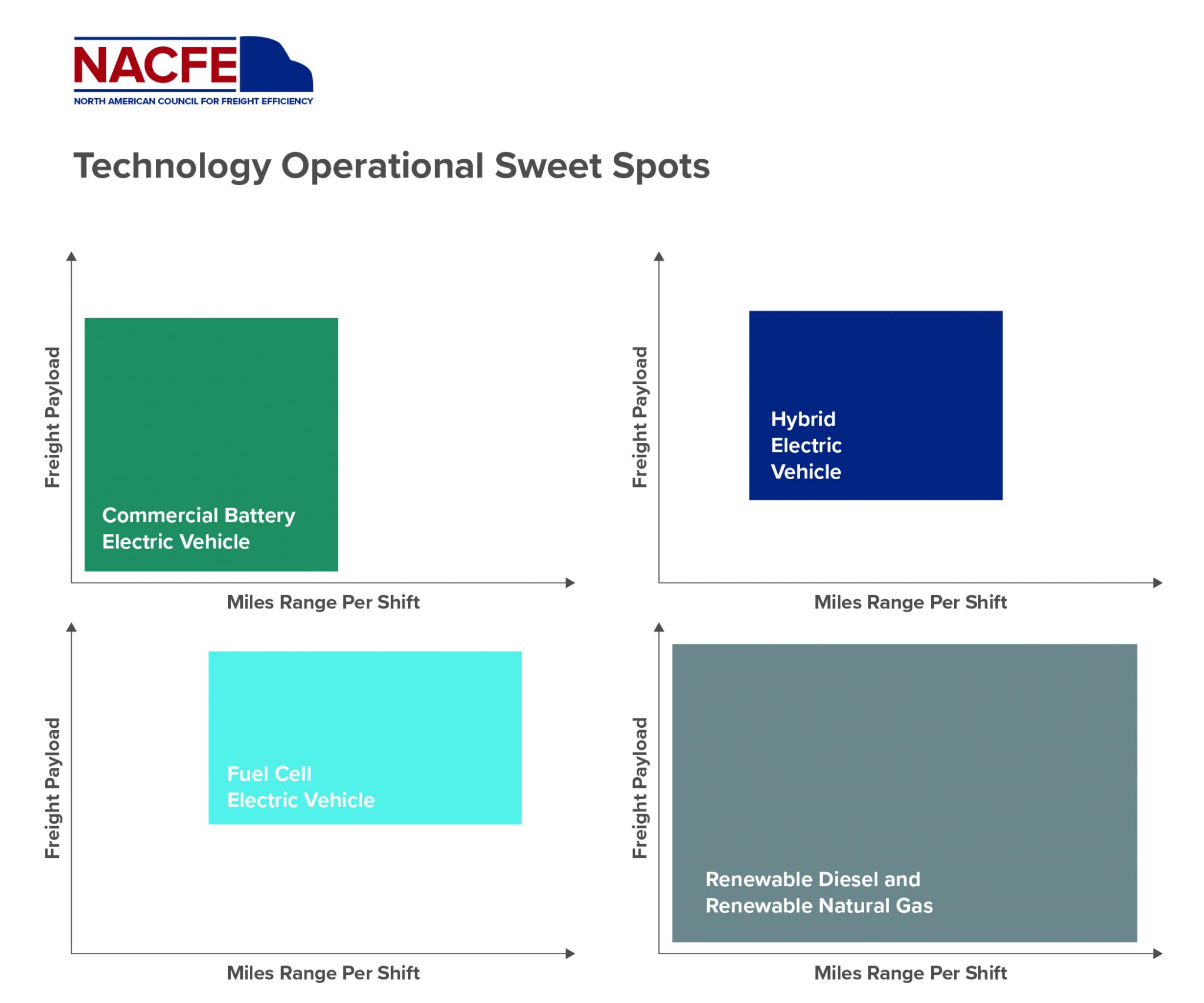

Common Fleet Strategies

A focus on efficiency has led several companies to optimize vehicle selection based on each specific duty cycle used in the company. This has led some companies to endorse having mixed technology fleets rather than a one-size-fits-all approach to vehicles. These decisions are driven by careful evaluation of the total cost of ownership and return on investment. The trend may not be true for all fleets, but it does reflect a modern trend toward specialization for product mixes.

Conclusions

- BEVs will not be a solution for every application or market, but commercial BEVs will have an increasing role in freight transportation in Classes 3 through 8.

- The rapid pace of battery energy density improvement will spur increases in BEV efficiency that likely cannot be matched by evolutionary changes to the internal combustion engines.

- The transition in specific market segments will be drawn out over decades, sharing space with traditional gasoline, diesel, and other alternative-fuel powertrains and also competing with other emerging technologies like fuel cells and hybrids.

- Mixed fleets (including diesel, natural gas, hybrid, and BEV products) optimized for specific routes and duty cycles will likely be the norm through 2050.

- Early adopters will be in the urban delivery Class 3 through 6 segments with fairly stable route definitions, loads that tend to cube out, and vehicles that run on shift and return to the same base location.

- BEVs require new electrical charging infrastructure, which will take time and capital to build

- Battery electric commercial vehicles must be reliable to gain market confidence.

- Maintenance and service cost reduction is an open question at this time.

- The net costs/benefits of BEVs require more effort than traditionally limited ROI calculations. Multiple factors need to be included, from the straightforward such as grants, incentives and taxes, to hard-to-dollar-quantify items such as emissions credits, brand image, liability costs, disposal costs, indirect costs, driver/technician retention or attraction, potential customers, and other opportunity costs/benefits buried in overhead or ignored in traditional ROI calculations.

- Longer ranges and heavier weights in Classes 7 and 8 are possible in specific operations, but may not be viable in all roles.

Decision-Making Tools

Medium-Duty Electric Trucks

Electric trucks are one alternative for fleets operating in the medium-duty market. In fact, the medium-duty market is the most likely candidate for significant near-term adoptions of battery electric vehicles.

Capital and speculative investment in battery electric vehicle development is bringing a number of products into commercial production. Evolving regional and national emissions regulations have created sufficient demand for zero- and near-zero-emission vehicles, and original equipment manufacturers and start-ups are bringing viable battery electric vehicles to market. Medium-duty commercial battery electric vehicles are not the solution for every market, but they are a viable alternative in daily return-to-base urban applications of fewer than 100 miles per day.

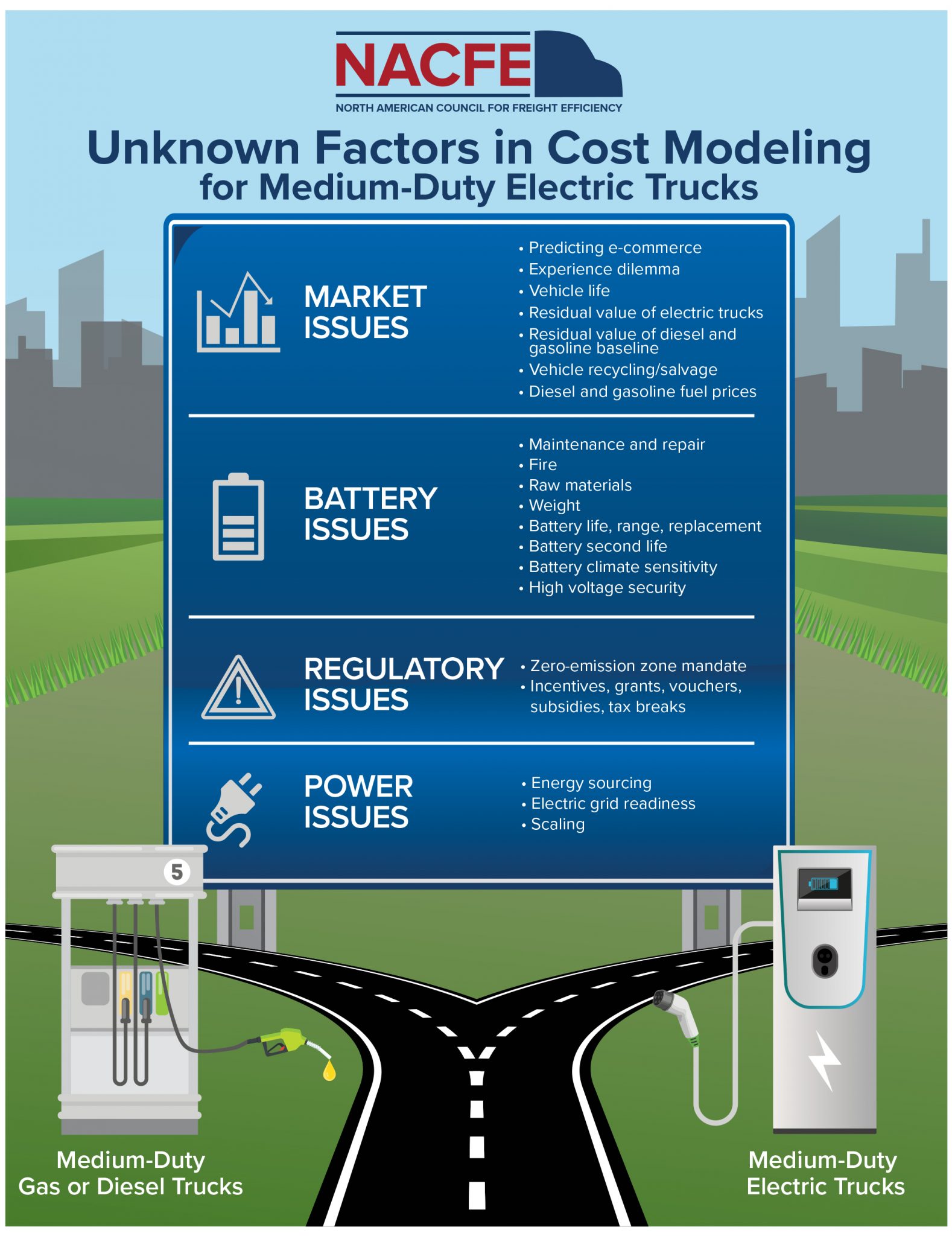

Knowns and Unknowns

Because field history is minimal, total-cost-of-ownership cost modeling for battery electric vehicles involves a number of projections, estimates, and guesses. NACFE has identified 20 generally unknown factors concerning modern fleets.

Market Issues

Predicting e-commerce

The commercial space is rapidly changing, with traditional retail outlets being challenged by e-commerce companies and direct-to-consumer marketing. This shift has freight being delivered directly from warehouses to consumers, bypassing the traditional intermediate steps involved with getting the product to retail outlets. Regardless of whether the trend towards greater online purchasing continues, accelerates, or plateaus, the ability for medium-duty trucks to facilitate e-commerce growth in the next decade is promising, as is the use of battery electric vehicles. However, complex competitive, demographic, and political forces, as well as innovative technological advances make it challenging to predict the future e-commerce trajectory.

Experience dilemma

While new, small companies tend to innovate quickly by taking larger risks, mature OEMs and suppliers provide experience and stability. However, they also bring with them rigidity and the need to consider new investment opportunities in terms of existing product lines and operations. Fleets identified concern over risks with start-up companies and the long-term stability needed for fleets to make investments. Several fleets indicated that to reduce risk, established OEMs need to be involved in the electric truck market. Fleets had a parallel concern with speed-to-market, where established, large companies may take longer to get innovative, new product technology on the road as compared to smaller, more nimble start-ups.

Vehicle life

Capital investment in vehicles needs to factor in a period of ownership and expected vehicle lifespan. Medium-duty vehicles tend to be long lived, but battery electric vehicles have not been on the market for very long. Significant volumes of fielded production-quality trucks are needed to establish a basis for estimating commercial lifespans in this developing marketplace.

Residual value of electric trucks

There are insufficient quantities of used CBEVs to establish trends. Until there are sufficient suppliers of used vehicles to gauge market trends, estimating the lifespan of commercial battery electric vehicles is an unknown.

Residual value of diesel and gasoline baselines

Estimating residual value of these long-lived diesel or gasoline trucks is largely an unknown in the face of zero-emission mandates. Historical trends will not be applicable when a diesel truck is prohibited from use in specific markets.

Vehicle recycling/salvage

Total cost of ownership evaluation includes estimating the residual value of a vehicle when traded. Often with medium-duty vehicles, the first owner keeps the vehicle its entire life. Thus residual value at end-of-life is based on the truck’s salvage value. Fleets operating electric vehicles found that, in some cases, parting out an electric vehicle had value as the electric motors, batteries, and parts of the control systems could be repurposed for things such as agricultural stationary uses like water pumping.

Diesel and gasoline prices

Oil and refined diesel and gasoline fuel prices have seen significant volatility since 2007. Long-term predictions may not have any credibility.

Battery Issues

Maintenance and repair

Maintenance cost reduction is a goal for fleets investing in CBEV trucks. An electric chassis, even one with a small ICE range extender-generator, in comparison has fewer moving parts, less caustic and hazardous fluids, and minimal high-temperature exhaust or emission systems. Battery electric vehicles are expected to extend preventive maintenance (PM) schedules for items like brakes and tires. The potential exists for significant maintenance cost reductions with battery electric vehicles, but NACFE concluded that maintenance reduction is not a near-term savings for medium-duty trucks. Early generation vehicles may be equal to, or worse than, competing diesel or gasoline ones.

Fire

Catastrophic events occur with all vehicle types. A common argument made by detractors of battery electric vehicles is that they catch fire, and then in showing a vehicle burning, infer the frequency is somehow alarming. However, there is no hard data to suggest this. Simply put, there is an insufficient volume of vehicles and history to accurately assess the issue.

Raw materials

Because OEM vehicle pricing is subject to flux from commodity volatility, the raw materials required to sustain production of battery electric vehicles represent concern to capital investment by fleets. Three example materials discussed frequently in conjunction with battery electric vehicles are cobalt, rare earth metals, and lithium.

Weight

Major segments of medium-duty delivery vehicles tend to cube out and are not sensitive to vehicle freight weight overloading. Vehicle weight for Class 3–6 medium-duty electric vehicle applications is not a significant risk for fleet operators as either they currently have sufficient weight margin with their freight loads or have alternate choices in GVW ratings and vehicle designs.

Battery life, range, replacement

Battery life is dependent on a number of operational factors. Vehicles require battery management systems to actively monitor the batteries, charging, discharging, and thermal profiles. With effective battery management and battery thermal-management systems, batteries can likely meet design life targets. Medium-duty vehicles tend to have long lives. If OEM battery design life is five, seven, or 10 years, then the total cost of ownership over a 10- to 30-year lifespan will require inclusion of battery replacements.

Battery second life

Recycling and repurposing medium-duty electric truck components will be a developing factor in the total cost of ownership estimation. At present, there is insufficient experience with second market aspects of these vehicles to place firm numbers on the value of used batteries, motors, controllers, etc.

Battery climate sensitivity

Regional environmental factors can contribute to battery discharge and charge rates. The concern for fleets investing in CBEVs is that deployment to harsher climate regions may necessitate more margin in battery sizing, or acceptance of shorter ranges than might be obtained in more moderate climates.

High voltage security

Fleets have concerns with driver and technician safety around high-voltage battery electric vehicles. The level of service-technician risk from battery electric vehicles is comparable to, or less than, that seen with diesel vehicles. Both fleets that are already operating electric vehicles and OEMs producing vehicles report that proper training is the key to ensuring a safe work environment.

Regulatory Issues

Zero-emission zone mandates

Regulatory mandates to adopt zero-emission vehicles in specific regions force manufacturers to produce viable alternative technology platforms. Currently, ten states have adopted the California-based Zero-Emission Vehicle Program. Zero-emission mandates may apply to specific municipalities, regions, or entire states.

Incentives, grants, vouchers, subsidies, tax breaks

The primary purpose of incentives, grants, vouchers, subsidies, rebates, and/or tax breaks is to encourage the behavior of buying and using zero- and low-emission vehicles and, conversely, discourage the behavior of buying and using diesel and gasoline vehicles. Justification for subsidizing an industry rests on the belief that a new technology cannot compete on price because it does not yet have the benefit of economies of scale. Companies making capital investments in electric vehicle technology may wonder if subsidies could disappear before they have built out their fleet. The pervasiveness of subsidies combined with the slow adoption rate of commercial electric vehicles, suggests that subsidies may be a factor for the foreseeable future.

Power Issues

Energy sourcing

There is a key difference between diesel-based and battery electric vehicles; diesel is a fuel and electricity is more like an energy carrier—and the energy can be produced by a wide variety of methods. This inherent flexibility means that vehicles are not tied to the economics of one energy source. Electrical charging can be tied to any and all electricity sources.

Electric grid readiness

Because capital investment requires downstream cash flows to provide returns, grid capacity tends to lag demand. Instantly building out the national grid to support proposed millions of future electric vehicles would mean a great deal of excess capacity waiting for OEMs to ramp up production. The electrical grid will respond to the increased electric vehicle volumes by making investments where demand is exceeding supply. Lead times for installation of vehicle charging systems can be six months to more than a year.

Scaling

The greatest concern to scaling the number of CBEVs at a site is the lead times for the charging infrastructure. Where the number of CBEV chargers at a site requires significant infrastructure changes to get power to a site, fleets will need to work with utilities and municipalities to coordinate the work.

Summary Findings

There are uncertainties when it comes to medium-duty battery electric vehicles, in large part because there aren’t a significant number of production level vehicles on the road, accumulating significant miles of fleet use. The potential for significant savings from CBEVs is there, but the industry is still very early in deploying quality vehicles into real-world conditions.

Some key findings include:

- Daily return-to-base urban delivery cycles fewer than 100 miles are well suited for battery electric vehicles.

- The primary justification for CBEVs is to achieve zero-emissions objectives.

- Because there is little long-term operational data, CBEVs have many unknowns.

- E-commerce is increasing the need for medium-duty last mile deliveries.

Recommendations

CBEVs are no longer speculation. They are clearly entering the North American marketplace with every major existing OEM, and a number of new OEMs, introducing products. Electric trucks will succeed or fail under the intense spotlight of the marketplace. Fleets choosing electric trucks today will get on the learning curve ahead of those that wait. Early adopters will expose flaws and omissions that OEMs will correct. They will validate or dismiss CBEV claims. They will also learn how to optimize their operations to make the most of electric vehicles for improving their company’s bottom line financials. As CBEVs improve, these early adopters will be better positioned to rapidly take advantage of the improvements.

Decision-Making Tools

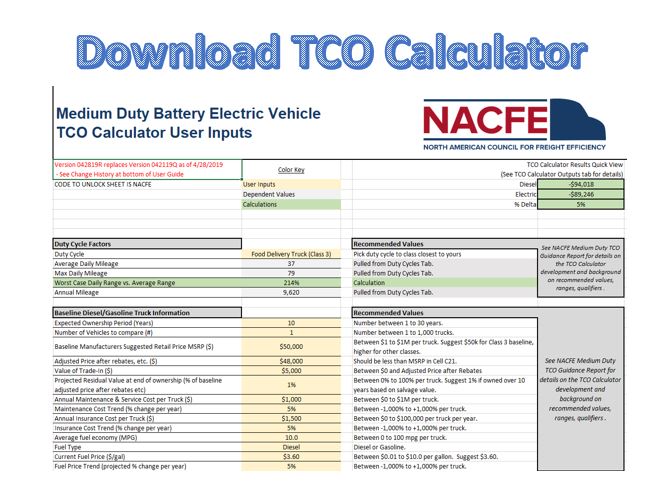

NACFE designed a total cost of ownership (TCO) calculator to allow fleets to compare investment in one or several diesel or gasoline powered baseline trucks against an equivalent battery electric alternative. The calculator includes factors NACFE found relevant to this comparison.

Viable Class 7/8 Electric, Hybrid, and Alternative Fuel Tractors

Trucking is at the start of significant changes in powertrains. Fleets face a tyranny of evolving choices that include improved diesels, a seemingly endless variety of hybrid technologies including fuel cells, and a variety of straight electric ones including battery electric and catenary wire electric. Fuels are branded variously as “green,” “clean,” “near-zero emission” and “renewable” with no clear agreement on what these mean.

This report provides unbiased information on the current progress, trade-offs, and key considerations for fleets evaluating alternatives to traditional diesel powertrains.

How Are Alternative Fuels Alike?

The alternatives to traditional diesel powertrains share common factors such as:

- Unproven Reliability

- Unproven Maintainability

- Unknown Obsolescence Rate

- Unproven Product Life

- Unknown All Season/All Region Capabilities

- Higher List Cost

- Unknown Lifecycle Costs

- Need for Infrastructure Investment

- Unknown Insurance Costs

- Unknown Residual Value

- Maturation and Adoption S-Curves

How Are Alternative Fuels Different?

Comparing alternative fuels on a true apples-to-apples basis means comparing identical vehicles. Since alternative fueled vehicles are inherently not identical, each factor that is not kept similar has ramifications that impact the validity of the comparison. Alternative fuel vehicle equivalent comparisons are difficult. In order to do an accurate comparison, the following factors have to be taken into consideration:

- Energy Content of Fuels

- Tare Weight

- Payload Capacity

- Vehicle Packaging

- Energy Conversion Efficiency

- Duty Cycles

- Freight Ton Efficiency

- Freight Cube

- Energy Pricing

- Source-to-Use

- Fill Times

- System Cost

- Maintenance

- Incentives

- Other Operational Factors

Conclusions

- North American freight movement is becoming more predictable with dedicated routes enabled by e-commerce and other technologies, offering better duty cycles for alternative powertrains.

- Each alternative fuel powertrain offers benefits in the short term compared to current diesel and may have enough duty cycle scale to offer TCO and emission savings.

- CBEVs and Fuel Cell trucks will be capable of lower total cost of ownership in the 2030 timeframe.

- Vehicle specifications will be more optimized for the duty cycle and technology of the first user, limiting the applicability of the equipment for second or third users.

- There will be a “messy middle” until CBEVs and FCEVs alone power these trucks, as alternatives offer significant improvements over the diesel and gasoline baselines.

- A future zero-emission freight world will only have electric based vehicles (CBEV, FCEV, or catenary electric) powered well to wheel from truly renewable sources such as hydro, solar and wind.

Future Outlook

With growing levels of goods movement and increased pressure for cleaner transport, trucking is facing growing demand for near-zero or zero-emission solutions. As a result, the list of alternative fuels and related powertrains is growing, and these technologies are beginning to reach the point of production-quality vehicles. In the past, natural gas powertrains lead the way, but the bulk of the current investment is going into newer options like fuel cells and battery electric vehicles.

NACFE believes there is no single solution to replace diesel. Instead, specialization and regional factors are pushing the market to a “multi-fuel future” where many of these technologies will coexist.

NACFE concludes that in the long run, electric powertrains will predominate the marketplace due to the efficiency of battery electric powertrains for transporting freight when viewed from well to wheel. Through this transition, some technologies will emerge as “bridges” between the present and the future.

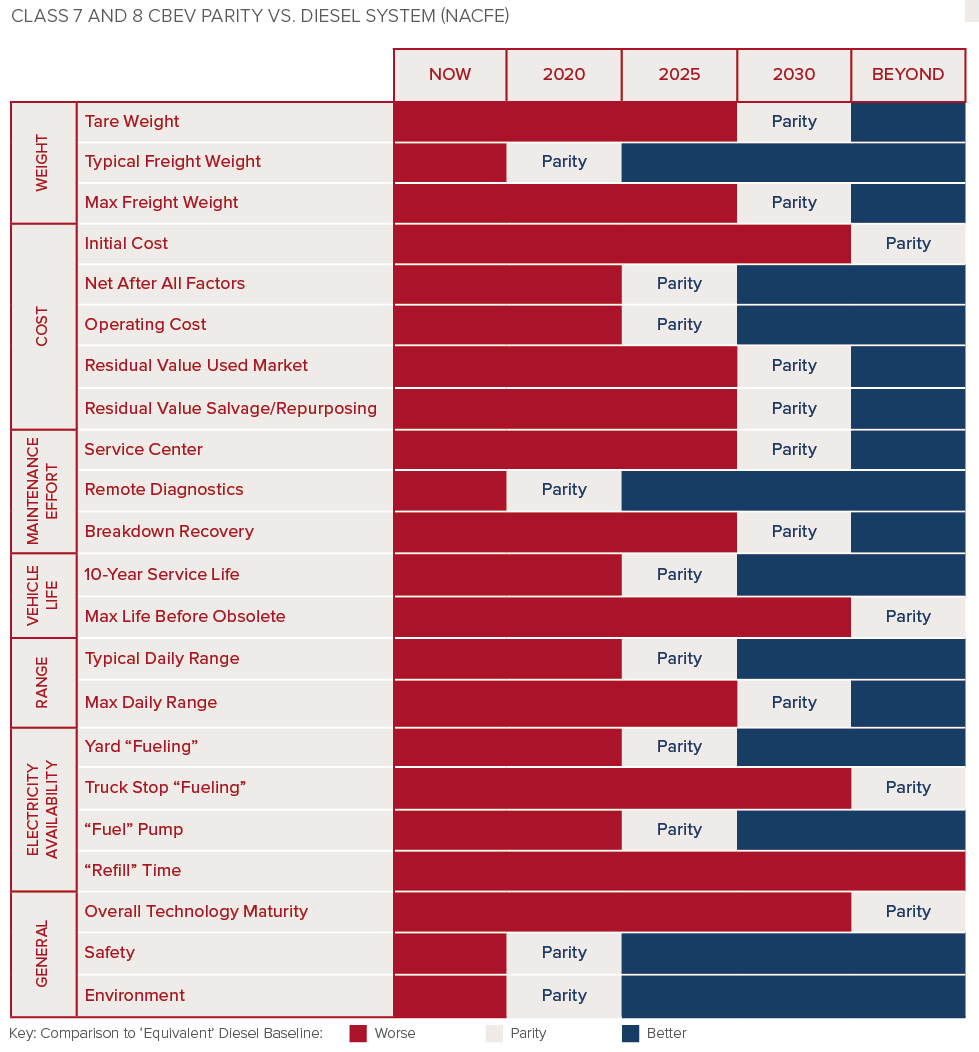

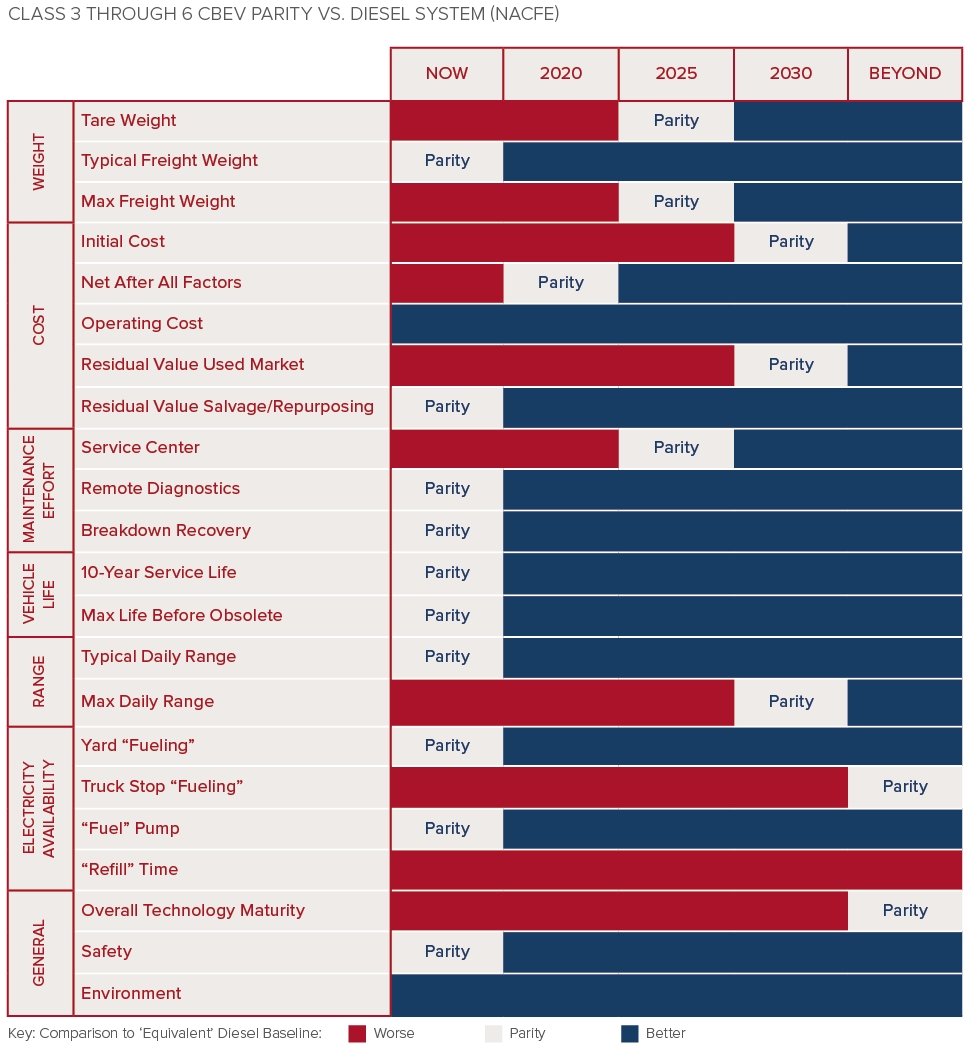

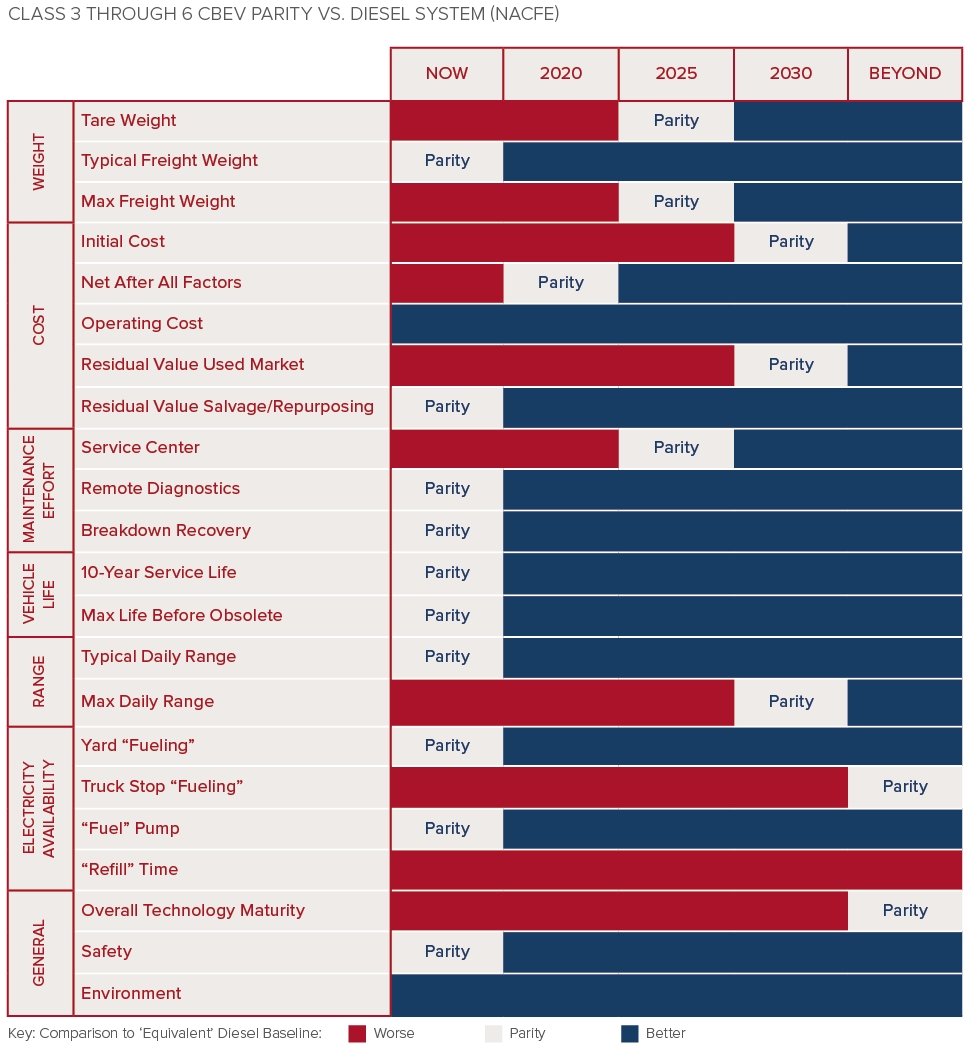

Decision-Making Tools

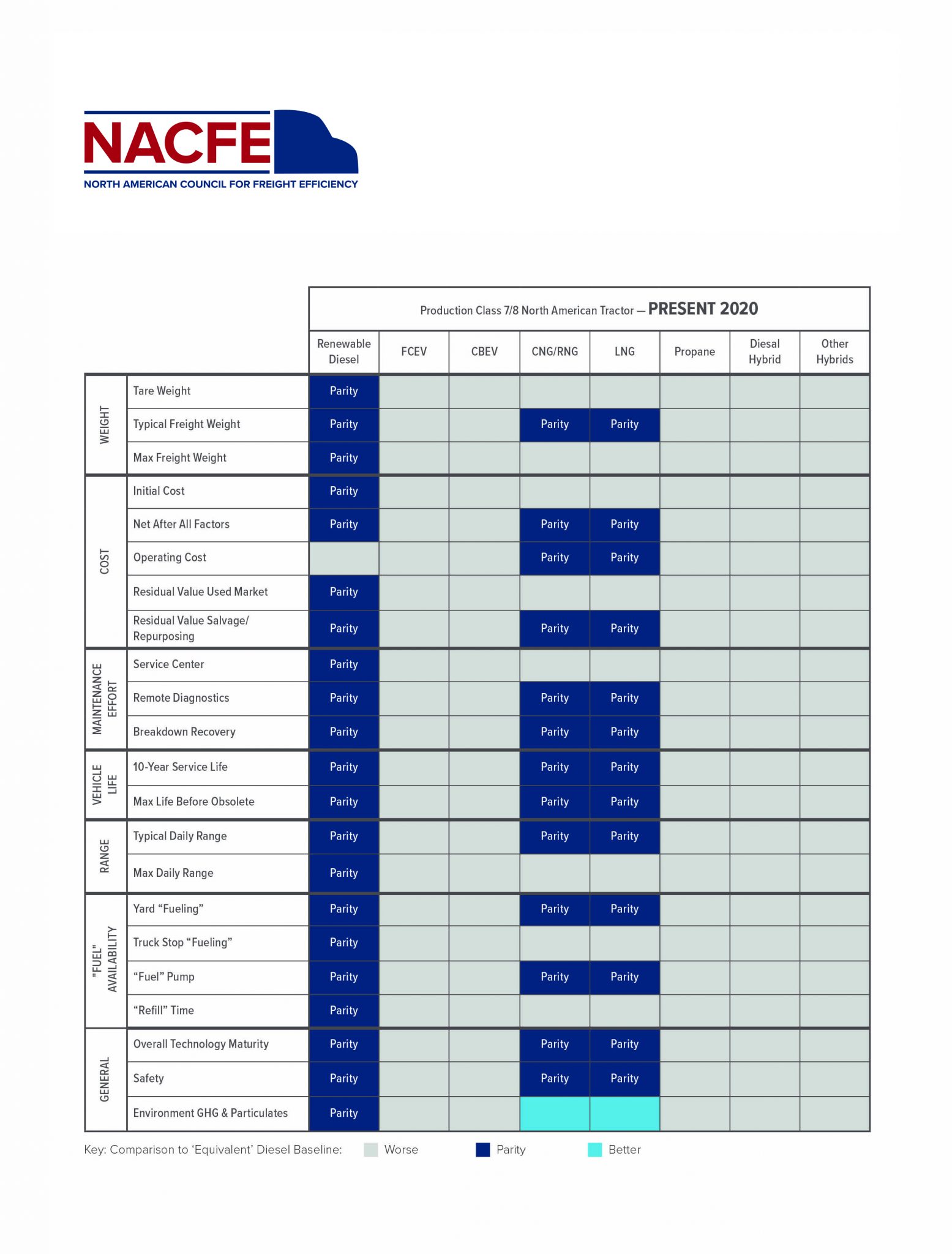

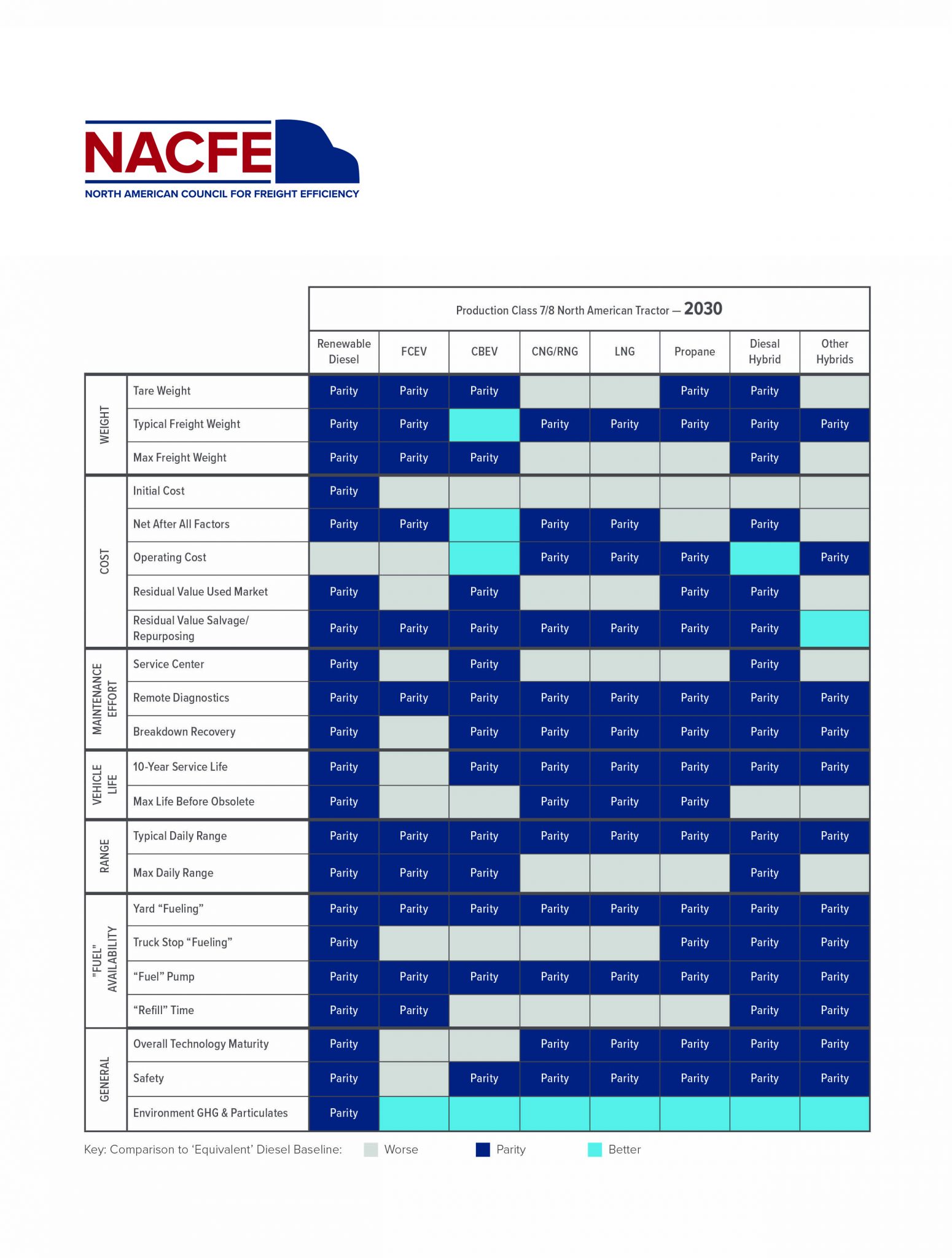

There are 22 parity factors related to comparing battery electric vehicles to current diesel vehicles. Using the alternative fuel powertrains outside of CNG/RNG and LNG vehicles.

Two charts show alternative fuel powertrain parity compared to diesel. One looks at the current situation and the other projects out to 2030.

Electric Truck Primers

For Commercial Truck Electrification

Overview

Freight electrification is opening new opportunities and challenges for the freight industry and utilities alike. Both groups need to show flexibility to innovate business solutions that allow both to be successful in this evolving market.

Utilities, trucking companies, truck manufacturers, charging infrastructure companies, and governments will need to collaborate closely to realize the full potential of electrification in the transportation of goods.

NACFE developed primers for both fleets and utilities to help facilitate conversations between fleets and utilities to help get North America on the road to truck electrification.